Numbers Bars

- Introduction

- Definitions

- Step-By-Step Instructions

- Example Numbers Bars Chart

- Scaling a Numbers Bars Chart

- Adjusting Tick Size For Larger Increment

- Numbers Bars Text Types

- Numbers Bars Background Types

- Numbers Bars Background Coloring Methods

- Numbers Bars Text Coloring Methods

- Using Text and Background Coloring Methods at Same Time

- Text Not Appearing

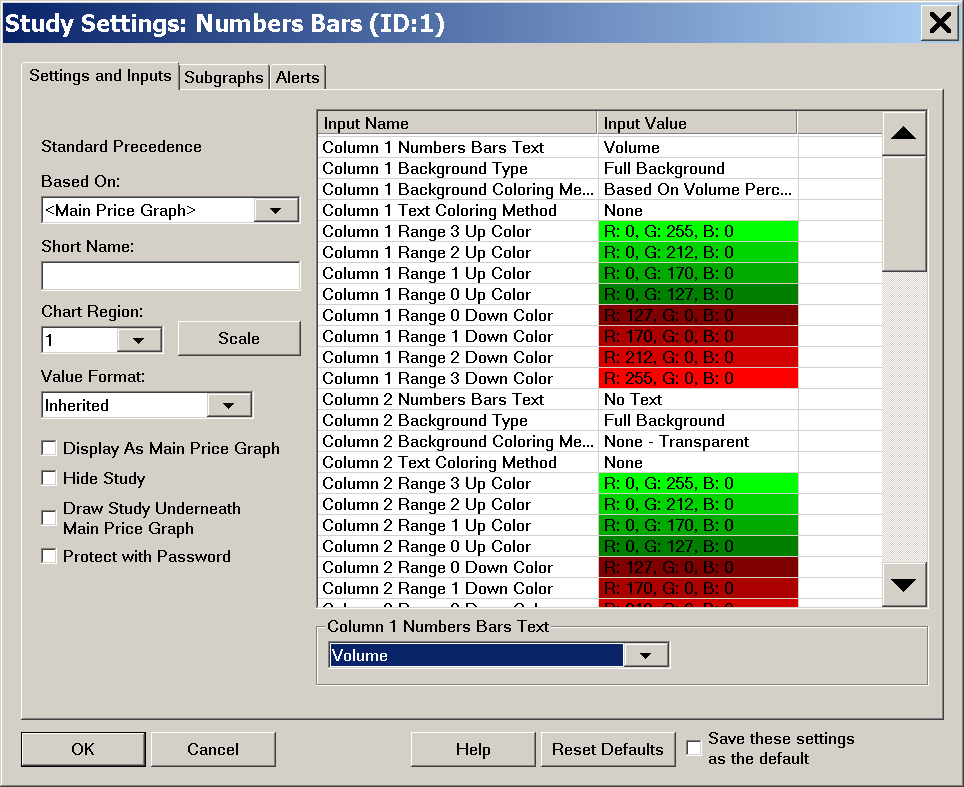

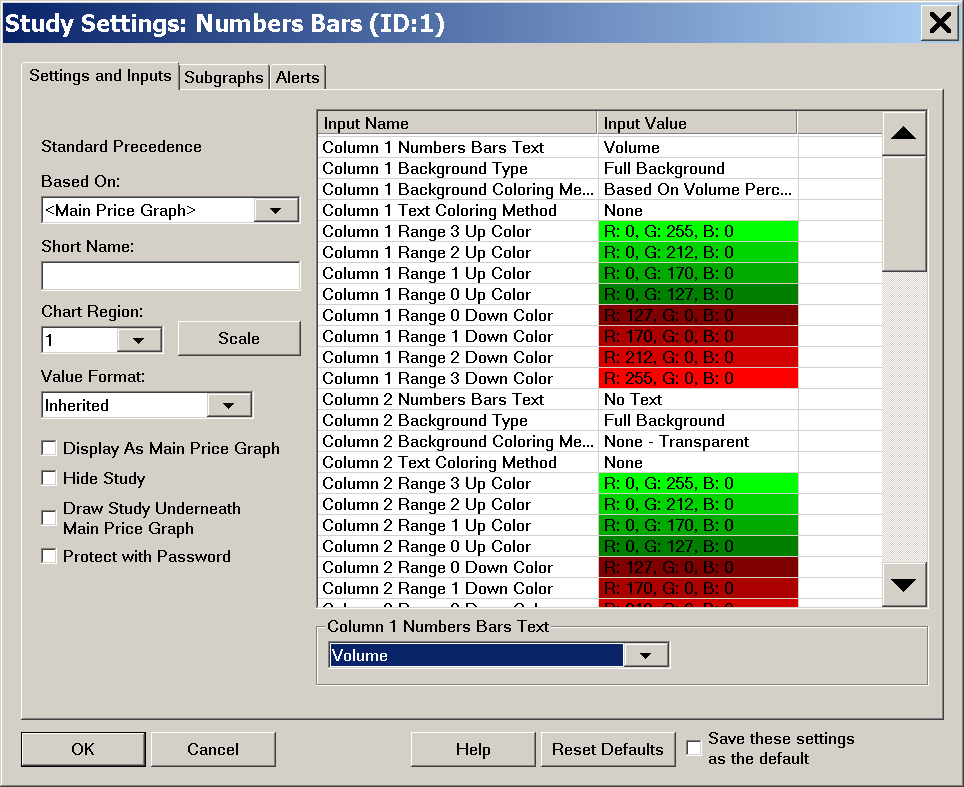

- Input Settings for Numbers Bars

- Column # Numbers Bars Text

- Column # Background Type

- Column # Background Coloring Method

- Column # Text Coloring Method

- Column # Range 3 Up Color

- Column # Range 2 Up Color

- Column # Range 1 Up Color

- Column # Range 0 Up Color

- Column # Range 0 Down Color

- Column # Range 1 Down Color

- Column # Range 2 Down Color

- Column # Range 3 Down Color

- Pullback Column # Numbers Bars Text

- Pullback Column # Background Type

- Pullback Column # Background Coloring Method

- Pullback Column # Text Coloring Method

- Default Text Color

- Color Non-Dominant Ask/Bid Text Same as Opposing Side

- Highlight Minimum Value In

- Minimum Highlight Color

- Minimum Highlight Line Width

- Highlight Maximum Value In

- Maximum Highlight Color

- Maximum Highlight Line Width

- Highlight Point Of Control In

- Point Of Control Highlight Color

- Point Of Control Highlight Line Width

- Highlight Equal Bid and Ask Volumes In

- Equal Bid and Ask Volumes Highlight Color

- Equal Bid and Ask Volumes Line Width

- Open and Close Marker Style

- Place Open Marker / Boxes In

- Place Close Marker In

- Open Marker / Up Box Color

- Close Marker / Down Box Color

- Single Value Text Alignment

- Bold/Highlight Last Trade Price

- Last Trade Bid Highlight Color

- Last Trade Ask Highlight Color

- Bid / Ask Bold Threshold

- Numbers Separator Character

- Font Size Mode

- Maximum Font Size for Automatic Font Size

- Minimum Font Size for Automatic Font Size

- Show Historical Pullback AskVolume BidVolume Difference

- Historical High Pullback Color

- Historical Low Pullback Color

- Historical Pullback Font Size

- Draw Historical Pullback Separator

- Determine Maximum/Minimum Values for Coloring From

- Column # Percent Compare Thresholds

- Bid/Ask Volume Text Threshold

- Bid/Ask Minimum Volume Compare Threshold

- Enable Diagonal Bid/Ask Compare with No Data at High/Low

- Enable Bid/Ask Ratios with Zeros as Ones

- Highlight Maximum/Minimum Value Based On

- Column # Actual Compare Thresholds

- Candlestick Outline Width

- Pullback Column Right Offset in Pixels

- Volume Profile Bars Length Relative to All Visible Bars

- Use Separate Colors for Text Coloring Method

- Range 3 Up Color for Text

- Range 2 Up Color for Text

- Range 1 Up Color for Text

- Range 0 Up Color for Text

- Range 0 Down Color for Text

- Range 1 Down Color for Text

- Range 2 Down Color for Text

- Range 3 Down Color for Text

- Highlight Nonzero Bid&Ask Volume at High/Low

- Highlight Nonzero Bid&Ask at High/Low in Pullback Columns

- Highlight Nonzero Bid&Ask at High/Low Threshold

- Use Large Volume Number Formatting

- Default Background Color

- Require 1 Tick Intraday Data Storage Time

- Outline Width For Background Types

- Ignore 0 Values for Minimum Highlight

- Ignore High and Low Prices for Highlight Minimum Value In

- Volume Display Multiplier

- Spacing Adjustment Value

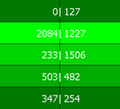

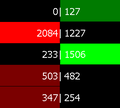

- Color Settings and Logic for Numbers Bars

- Background Coloring Methods Logic

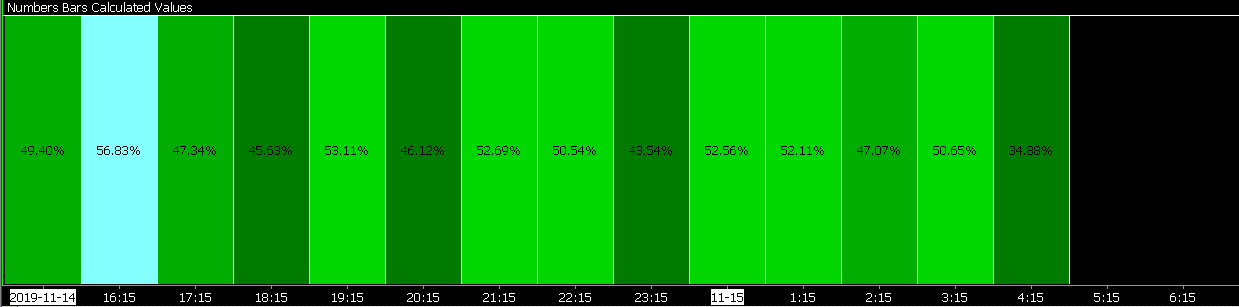

- Background Coloring Based on Volume Percentage

- Background Coloring Based on Trades Percentage

- Background Coloring Based on AskVol/BidVol Percentage

- Background Coloring Based on Dominant AskVol BidVol To Volume At Price Percentage

- Background Coloring Based on Above/At or Below Last

- Background Coloring Based on Dominant Side AskVol BidVol Percentage

- Background Coloring Based on Diagonal Dominant Side AskVol BidVol Percentage

- Background Coloring Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage

- Background Coloring Based on Diagonal Dominant AskVol BidVol Difference - Actual

- Background Coloring Based on AskVol BidVol Diagonal Difference Percentage of Bar Range

- Background Coloring Based on Volume - Actual

- Background Coloring Based on Trades - Actual

- Background Coloring Based on Dominant AskVol BidVol - Actual

- Background Coloring Based on AskVol BidVol Difference - Actual

- Background Coloring Based on Separate Ask Volume Bid Volume - Actual

- Background Coloring Based on Separate Diagonal AskVol BidVol Percentage

- Background Coloring Based on Separate AskVol BidVol Percentage

- Background Coloring Based on Dominant Total Volume - Actual

- Background Coloring Based on AskVol BidVol Difference Percentage of Max Dominant Side

- Background Coloring Based on Diagonal Dominant AskVol BidVol - Actual

- Text Coloring Methods Logic

- Text Coloring Based on Volume Percentage

- Text Coloring Based on Trades Percentage

- Text Coloring Based on AskVol/BidVol Percentage

- Text Coloring Based on Dominant AskVol BidVol To Volume At Price Percentage

- Text Coloring Based on Above/At or Below Last

- Text Coloring Based on Dominant Side AskVol BidVol Percentage

- Text Coloring Based on Diagonal Dominant Side AskVol BidVol Percentage

- Text Coloring Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage

- Text Coloring Based on Diagonal Dominant AskVol BidVol Difference - Actual

- Text Coloring Based on AskVol BidVol Diagonal Difference Percentage of Bar Range

- Text Coloring Based on Volume - Actual

- Text Coloring Based on Trades - Actual

- Text Coloring Based on Dominant AskVol BidVol - Actual

- Text Coloring Based on AskVol BidVol Difference - Actual

- Text Coloring Based on Separate Ask Volume Bid Volume - Actual

- Text Coloring Based on Separate Diagonal AskVol BidVol Percentage

- Text Coloring Based on Separate AskVol BidVol Percentage

- Text Coloring Based on Dominant Total Volume - Actual

- Text Coloring Based on AskVol BidVol Difference Percentage of Max Dominant Side

- Text Coloring Based on Diagonal Dominant AskVol BidVol - Actual

- Background Coloring Methods Logic

- Diagonal Comparison of Bid Volume and Ask Volume

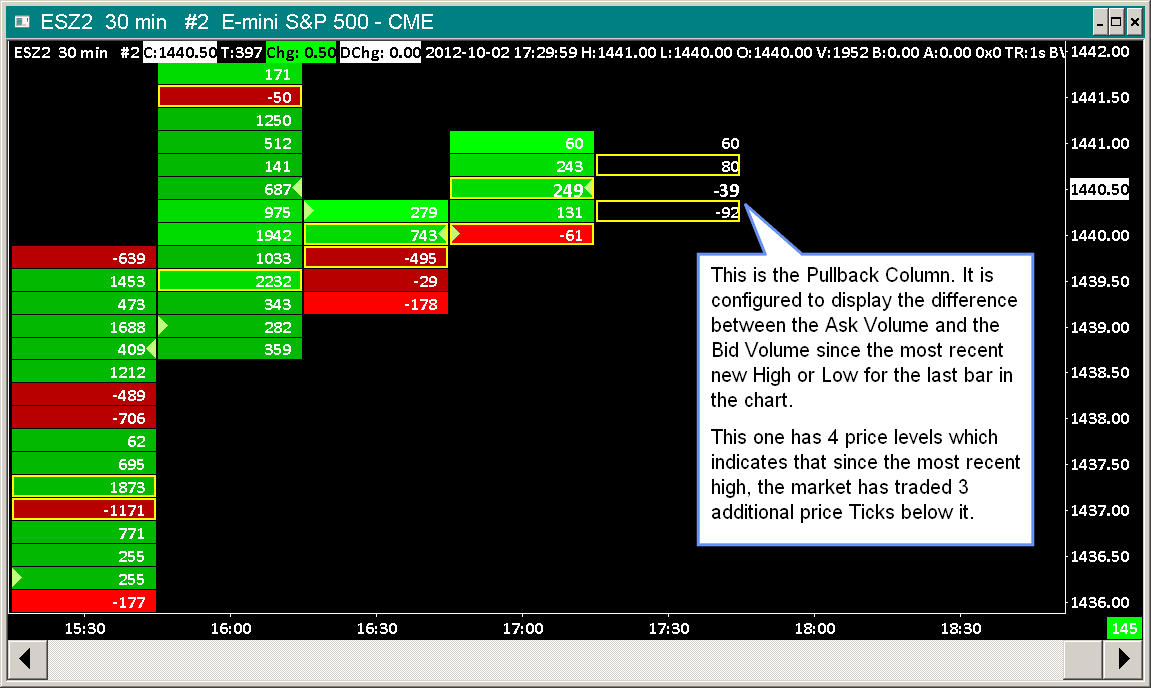

- Pullback Column

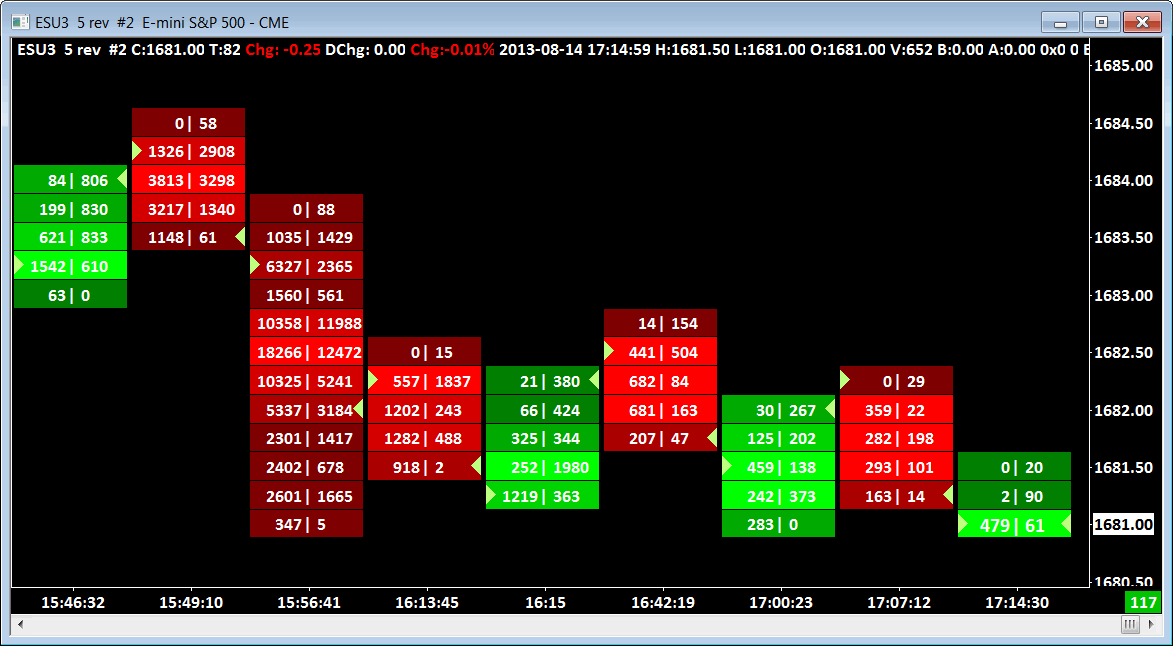

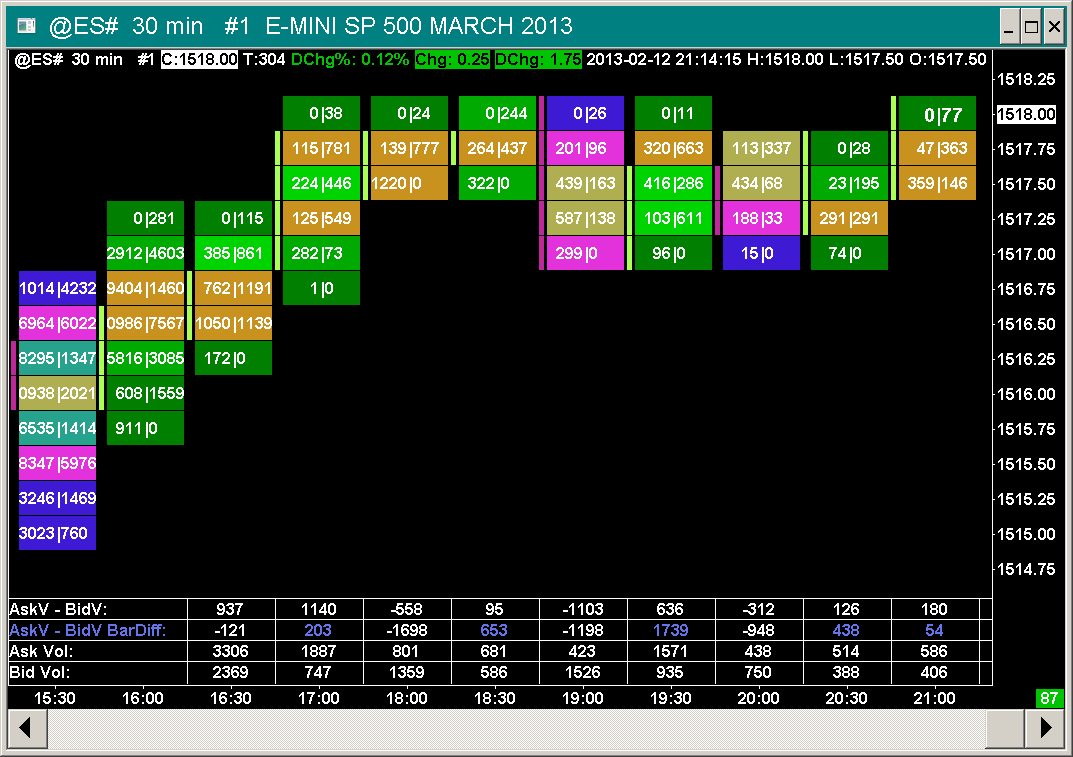

- Example Charts

- Font Size and Style for Numbers Bars

- Drawing Open to Close Boxes on Side of Numbers Bar

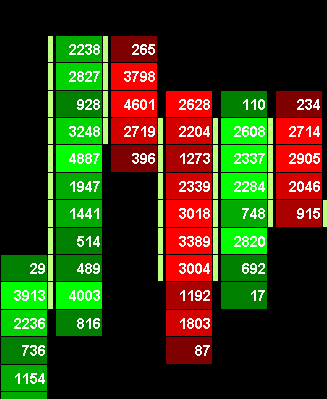

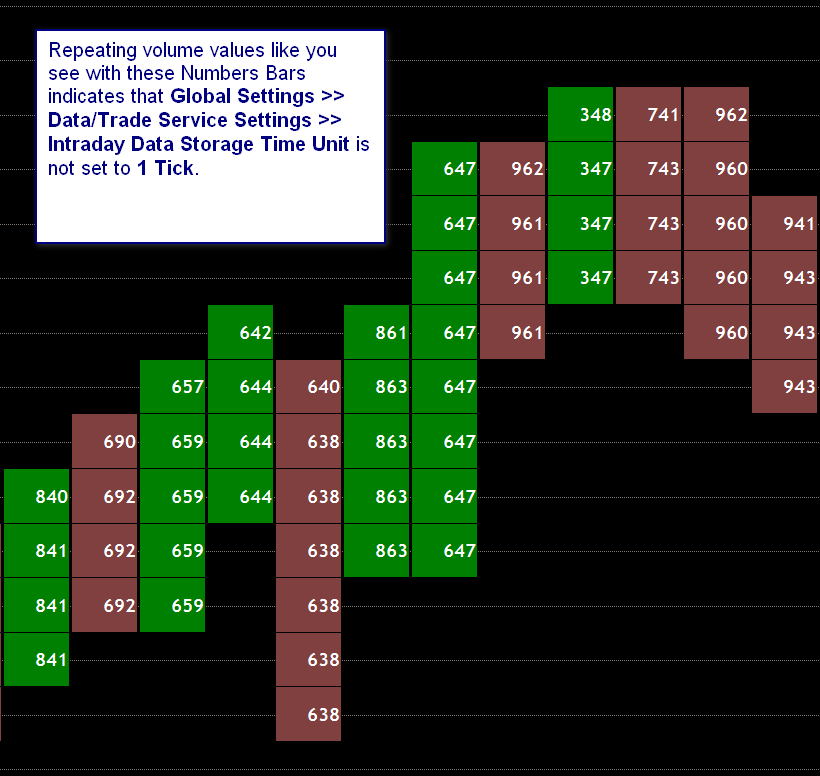

- Zero Volume Values and Repeating Volume Values

- Numbers Bars Accuracy / Values in Numbers Bars are Not Accurate

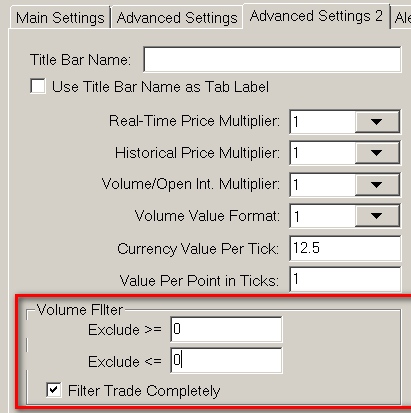

- Volume Filtering

- Using Numbers Bars on a Reversal Bars Chart

- Reset Study to Default Settings

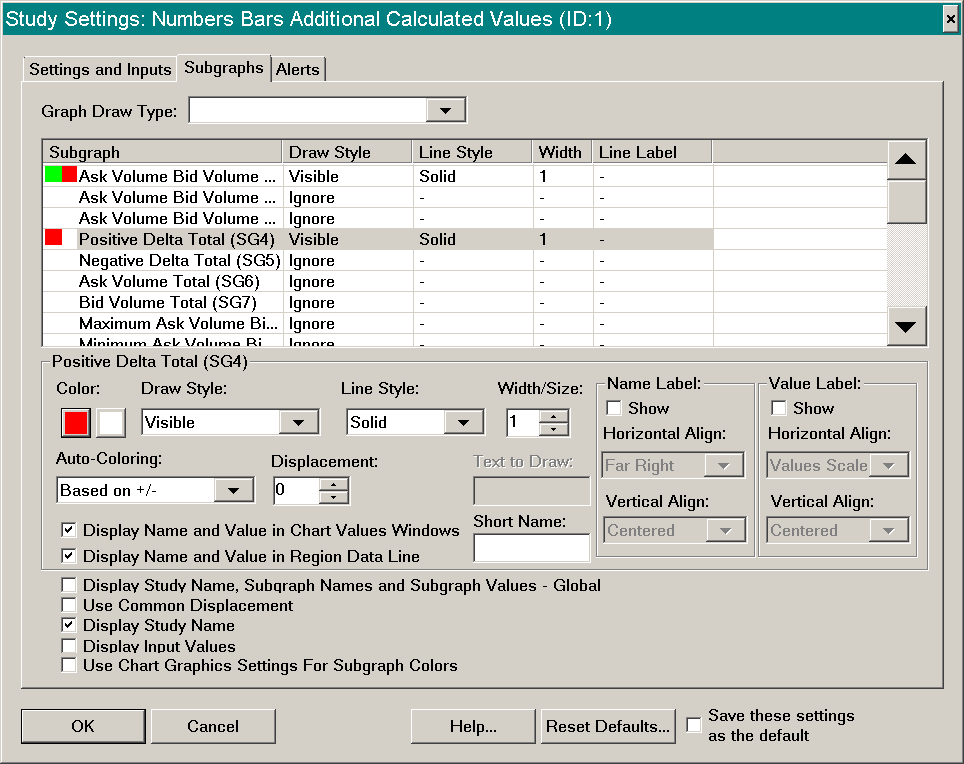

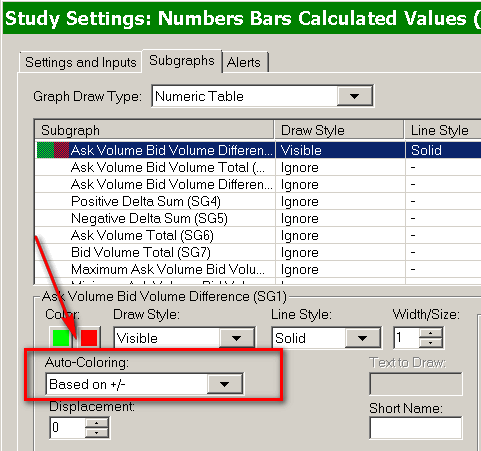

- Study to Display Total Bid Volume, Ask Volume, and Difference per Bar

- Using Multiple Numbers Bars Studies on the Same Chart

- Display Ask Bid Imbalance

- Highlight Multiple Adjacent Bid or Ask Dominant Prices (Stacked Imbalance) (Opens in new page)

- Displaying Numbers Bars In Another Region

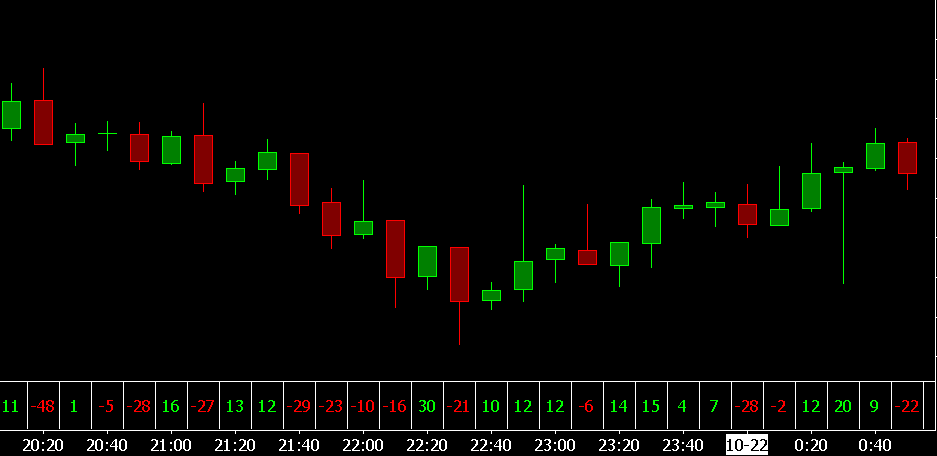

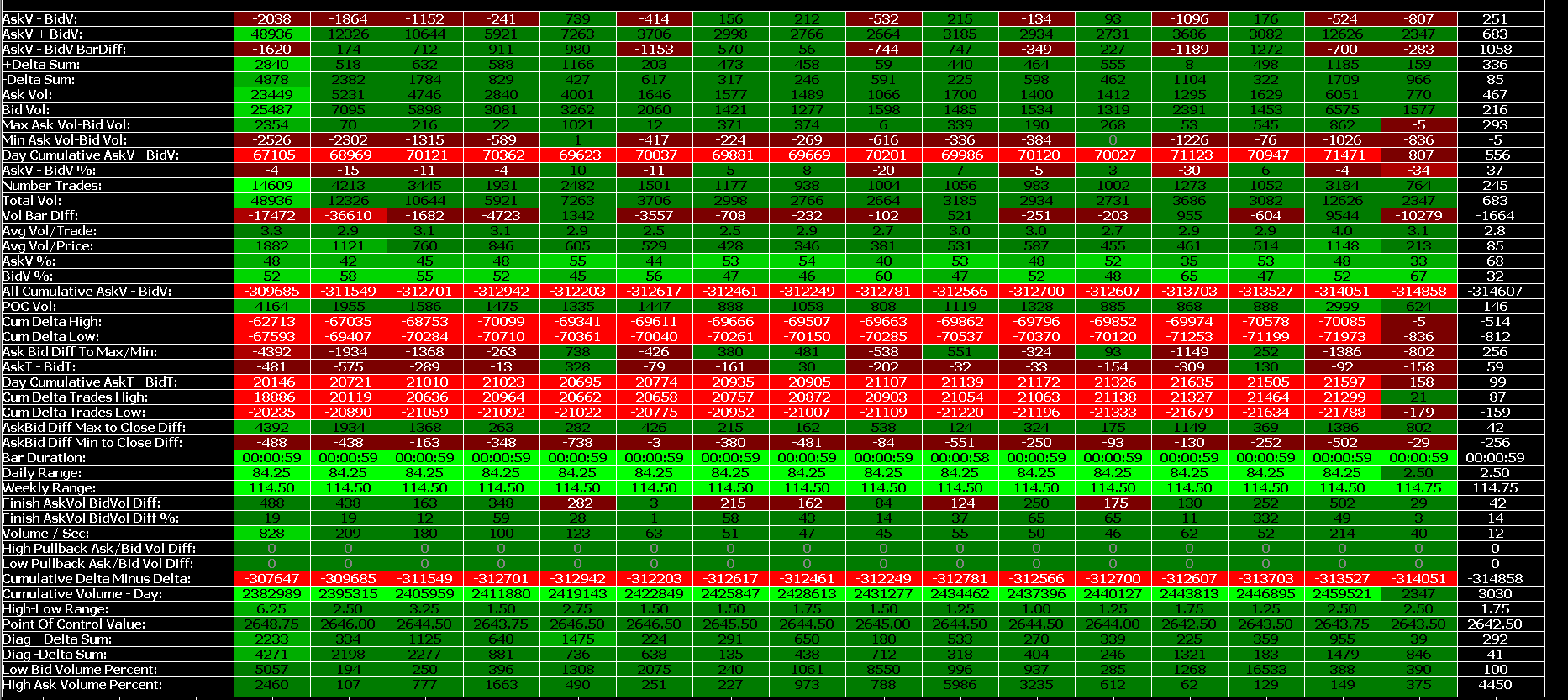

- Displaying Numeric Information Below Numbers Bars

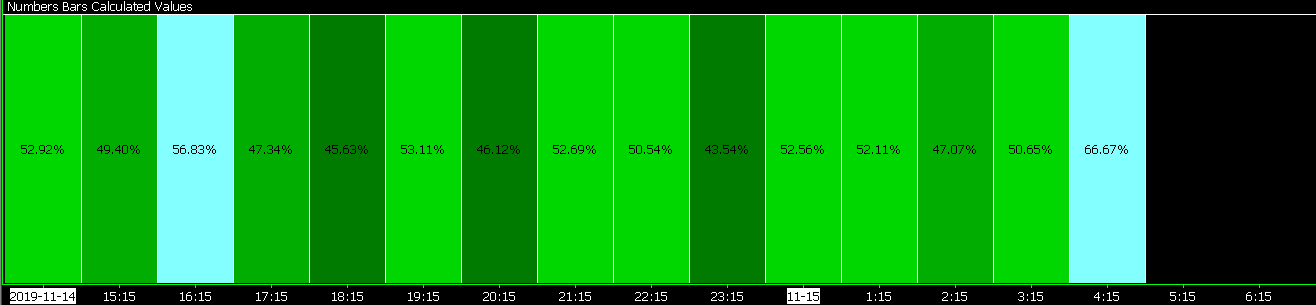

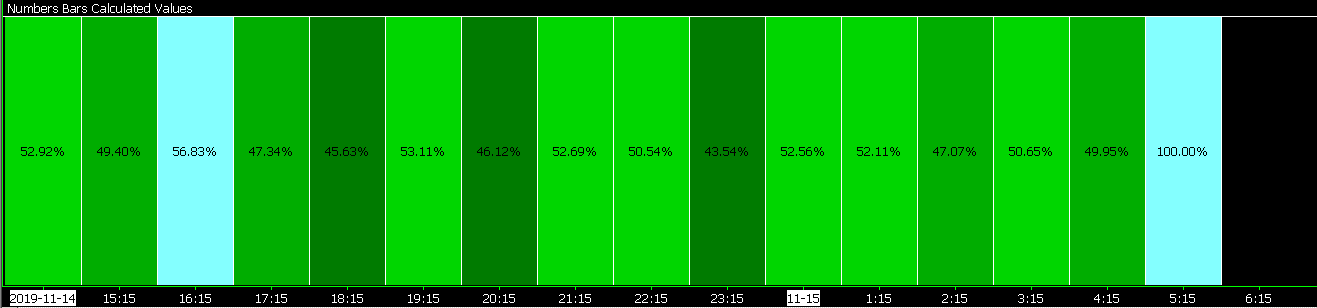

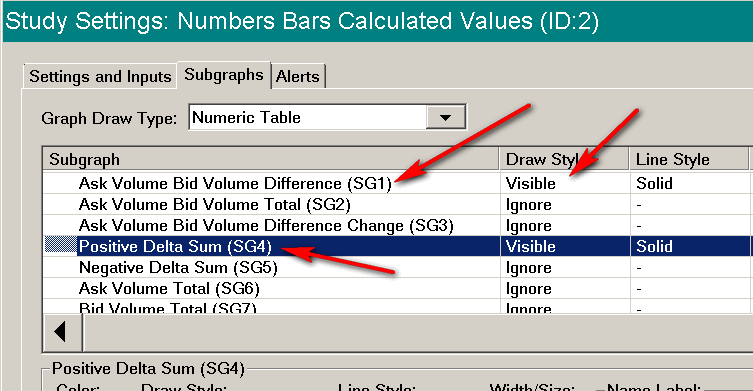

- Numbers Bars Calculated Values Input Descriptions

- Calculated Values Number Format

- Customizing the Calculated Values Rows Display Order

- Subgraph Descriptions

- Numbers Bars Calculated Values 2 Subgraph Descriptions

- Referencing Numbers Bars Calculated Values Subgraphs in Alert Formulas

- Calculated Values Background Coloring Logic

- Overlaying a Numbers Bars Calculated Values Study from Another Chart

Introduction

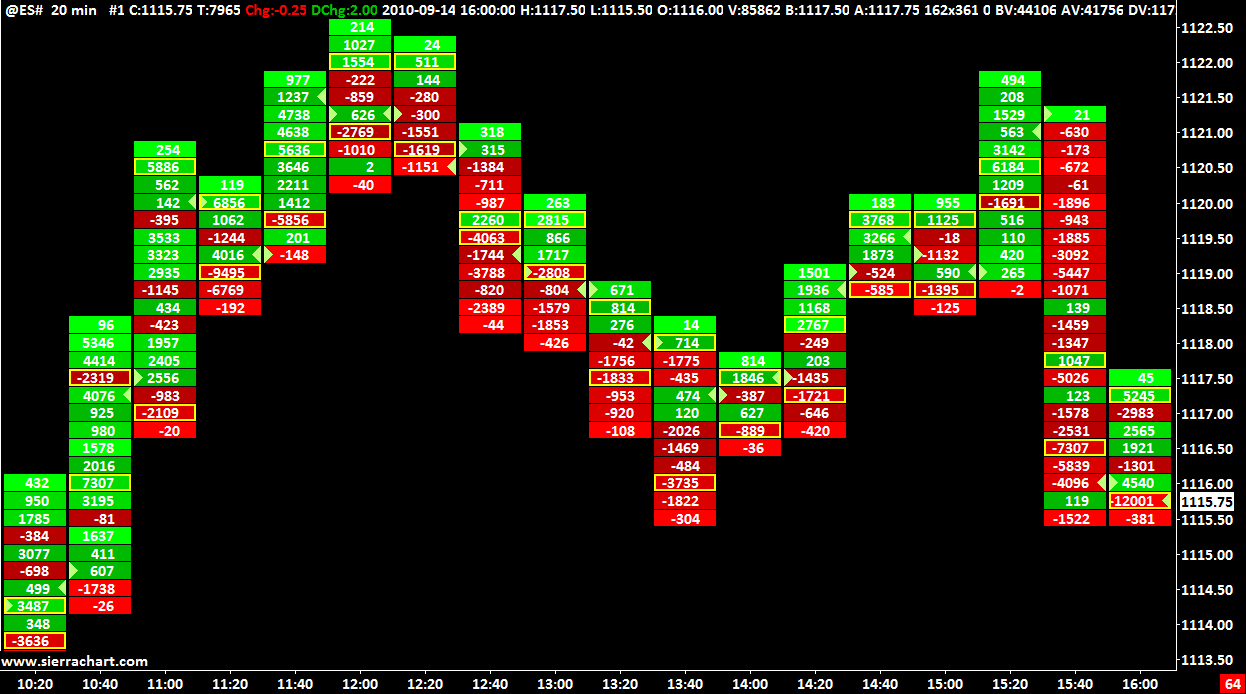

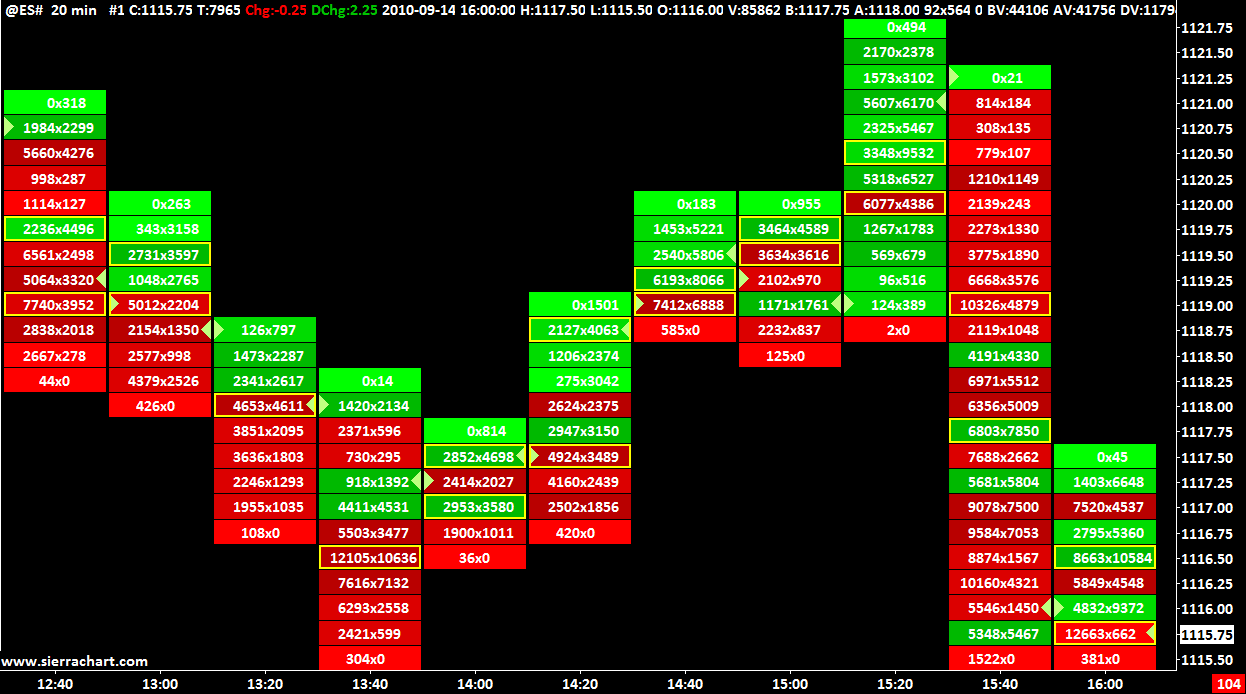

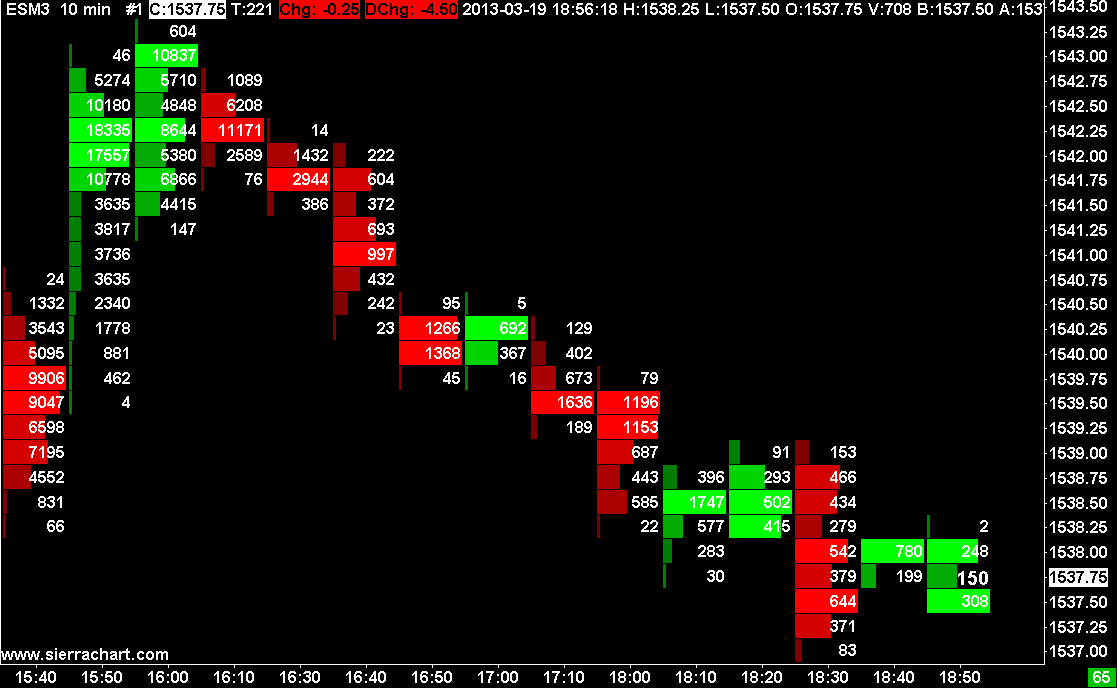

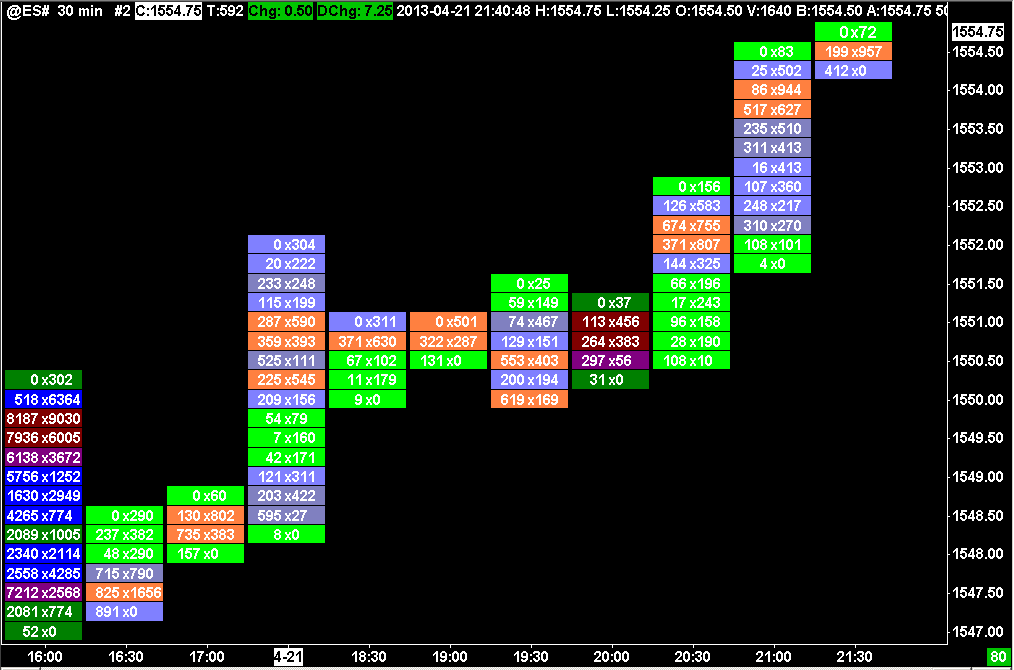

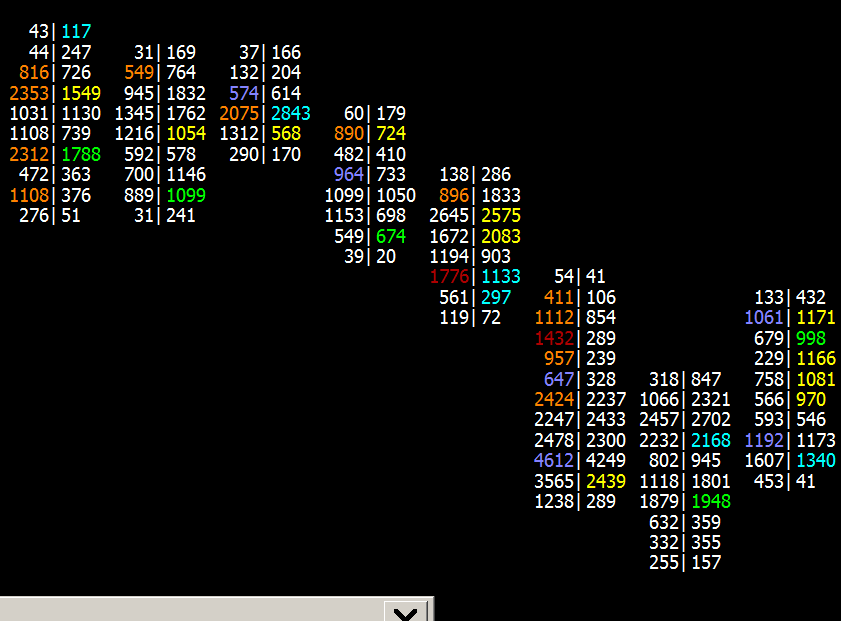

The Numbers Bars feature in Sierra Chart is a study that provides a very detailed view of the volume and trading activity within each individual bar in the chart. The regular price bars are replaced with up to 3 columns of numbers. There is a separate number or pair of numbers for each price level for each bar/column in the chart detailing the volume activity at that price level.

The numbers within a Numbers Bar can represent the difference between the Ask Volume and Bid Volume at each price level, the total Volume or number of Trades at each price level, the Ask Volume and Bid Volume at each price level, and other values. These bars reveal very detailed trading activity within a bar.

The Numbers Bars study can be configured to display multiple columns of data for each price bar. Each column can be configured to display different data. For example, the difference or delta between Ask Volume and Bid Volume, and another column can be configured to display the Ask Volume and Bid Volume individually.

The Numbers Bar study is highly configurable and there are numerous coloring options.

The Numbers Bars study only functions properly on Intraday charts. It cannot be used on Historical Daily charts.

The data records in the Intraday chart data file for the symbol need to be 1 Tick when using Numbers Bars. Otherwise, the displayed Numbers Bars data will be less accurate.

The Numbers Bars study does *not* require what is known as Market Depth data.

To get started using the Numbers Bars study, refer to Step-By-Step Instructions.

Numbers bars is also known as "Footprint" in other charting programs.

Definitions

This section gives definitions for various terms used on this page.

- Numbers Bar: A single column in the chart indicating various calculations at each price level.

- Bid: When the market is open for a symbol that can be traded, it will provide a Bid price. This is the current highest price that someone in the marketplace is willing to pay to complete a buy transaction for the symbol.

- Ask: When the market is open for a symbol that can be traded, it will provide an Ask price. This is the current lowest price that someone in the marketplace is willing to sell at to complete a sell transaction for the symbol.

- Trade: An agreement between a buyer and seller to take each side of a futures contract or to exchange stock shares. This also applies to other types of tradables. A single trade has a volume indicating the quantity of that trade. In the documentation, the term Trades is used to indicate the number of trades at a particular Numbers Bar price level or for a period of time. A single trade can have a Quantity or Volume which is greater than 1. Therefore, there is a difference between the number of trades at a price level and the quantity or volume of those trades at a price level.

- Tick : Tick has the same definition as Trade.

- Bid Trade [Link]: This is a Trade which is considered to have occurred at the Bid price. A Trade is considered to occur at the Bid price for one of the following reasons. Once one of these is true, there is no further evaluation of whether the Trade occurred at the Bid.

- The exchange or data feed has indicated the Trade has occurred at the Bid. If this is supported, this is the most accurate determination. In the case of the CME Group, EUREX, NASDAQ TotalView, CFE data from the Denali Exchange Data Feed, this is the method used. So there is 100% accuracy with this. This method is not used with CQG.

- The price of the Trade is at the Bid price or lower.

- The trade occurred between the Bid and the Ask and the Trade direction is a downtick and the Bid direction is a downtick.

- The Trade occurred between the Bid and the Ask and it is closer to the Bid.

- There has been no change in the last Trade price, and the last Trade was considered a Bid trade.

- The final determination is if the Trade direction is a downtick.

- The determination of whether a trade is at the Bid price, is not in any way affected by time stamping. The method of the determination is as explained above.

- Ask Trade [Link]: This is a Trade which is considered to have occurred at the Ask price. A Trade is considered to occur at the Ask price for one of the following reasons. Once one of these is true, there is no further evaluation of whether the Trade occurred at the Ask.

- The exchange or data feed has indicated the Trade has occurred at the Ask. If this is supported, this is the most accurate determination. In the case of the CME Group, EUREX, NASDAQ TotalView, CFE data from the Denali Exchange Data Feed, this is the method used. So there is 100% accuracy with this. This method is not used with CQG.

- The price of the Trade is at the Ask price or higher.

- The trade occurred between the Bid and the Ask and the Trade direction is an uptick and the Ask direction is an uptick.

- The Trade occurred between the Bid and the Ask and it is closer to the Ask.

- There has been no change in the last Trade price, and the last Trade was considered a Ask trade.

- The final determination is if the Trade direction is an uptick.

- The determination of whether a trade is at the Ask price, is not in any way affected by time stamping. The method of the determination is as explained above.

- Alternative Bid Trade / Ask Trade: In the case of HKFE, cash index symbols, the following method is how a trade is determined to be at the Bid or Ask price. In the case of exchange traded futures, although a trade must always occur at the Bid or Ask price, based upon the transmission of the Bid/Ask data from the exchange, often there is no synchronization between this Bid/Ask data and trades.

This is why this special algorithm is used. If the last trade price is the exact same price as previously, then if this price is equal to the current known Bid price, then it is considered a Bid Trade. If this price is equal to the current known Ask price, then it is considered an Ask Trade. Else if the last trade is an uptick or was previously an uptick, then the trade is considered to be an Ask Trade. If the last trade is a downtick or was previously a downtick, then the trade is considered to be a Bid Trade.

This section does not apply to IQ Feed data. - Bid Volume / Bid Trade Volume: This is the sum of all traded volume, not the number of trades, rather the number of contracts or shares traded, for a Numbers Bar price level or for period of time, that were Bid Trades (see description above).

- Ask Volume / Ask Trade Volume: This is the sum of all traded volume, not the number of trades, rather the number of contracts or shares traded, for a Numbers Bar price level or for period of time, that were Ask Trades (see description above).

- Delta: Sierra Chart does not normally use this term, since it is to generalized. Typically this means the difference between Ask Volume and Bid Volume at a particular Numbers Bar price level or for a period of time.

- Volume: The total quantity of futures contracts or stock shares traded at a particular Numbers Bar price level, or for a period of time. The Daily Volume for a symbol is the exchange reported Trade volume for the symbol for the trading day.

- Dominant Side: When comparing the Bid Volume and Ask Volume at a price level, the side with the larger value is considered the dominant side.

- Diagonal Dominant Side: Diagonal Dominant Side is similar to Dominant Side. The difference is the Bid Volume at one price level is compared diagonally to the Ask Volume at the next higher price level. And the Ask Volume is compared to the Bid Volume at the next lower price level.

The side with the larger value is the dominant side. Within a single price level, both the Bid Volume and Ask Volume could be dominant due to the diagonal comparisons of two different price levels.

Within a bar, the highest Bid Volume and lowest Ask Volume are never dominant because there is nothing to compare against higher or lower respectively. - Tick Size : Every symbol that can be traded has a Tick Size. The Tick Size for a symbol is the minimum value that the price for that symbol can change by. For example, the S&P ES futures has a Tick Size of .25.

- Market Depth Data: Market Depth data is data provided by an exchange that contains the quantities of Buy and Sell limit orders currently in the market at price levels nearby the current market price. Market Depth data is usually anywhere from 5 to 20 levels deep. The Numbers Bars study has no dependency on Market Depth data. Numbers Bars only requires the best Bid and Ask price. Any study in Sierra Chart that has a dependency on Bid Volume and Ask Volume, has no dependency on Market Depth data. They only require the best Bid and Ask price. Therefore, Market Depth data is not required for Numbers Bars or any study dependent on Bid Volume or Ask Volume.

Step-By-Step Instructions

- Your Sierra Chart account needs to have the Numbers Bars study feature. To change your Sierra Chart service package, select Help >> Account Control Panel on the menu. Click on the Set Service Package For Renewal link on the displayed webpage and follow the instructions to set the Usage Time Service Package to 5 (Advanced). After you change your service package, you will need to restart Sierra Chart.

- The data records in the Intraday chart data file for the symbol need to be 1 Tick when using Numbers Bars. Otherwise, the displayed Numbers Bars data will be less accurate. For instructions to set this, refer to Tick by Tick Data Configuration.

- Select Chart >> Chart Settings.

- Set Days to Load/Display to a small number, like 7, to reduce the amount of time it takes to load chart data due to the additional volume processing required when using Numbers Bars.

- Set the Tick Size if it is not set correctly. This is the minimum increment that the symbol trades in. In the case of foreign exchange symbols, this value should not be too small, otherwise it will increase the amount of time to build the Numbers Bars.

- Press OK to close the Chart Settings window.

- Select Analysis >> Studies on the menu.

- In Studies Available list, select the Numbers Bars study.

- Press the Add button.

- Press the Settings button.

- Select the Settings and Inputs tab.

- The Numbers Bars study supports the ability to configure up to 3 Numbers Bars columns per underlying chart bar. For example, if the chart bars are set to 10 minutes per bar, it is possible to define 3 Numbers Bars columns showing data for each 10 minute bar. You will notice in the list of Inputs for Numbers Bars study, 3 sets of Inputs, one for each column. These are numbered 1 through 3.

- Configure the Column # Numbers Bars Text for each of the 3 Numbers Bars columns you want to use. Numbers Bars can contain 1-3 columns of information. For each of the three columns, select one of the choices. For descriptions of each text type refer to Numbers Bars Text Types. If you only want to display a single column, then set Column 1 Numbers Bars Text to the Text type that you require and the other columns need to be set to No Text.

- Configure the Column # Background Type for each of the 3 Numbers Bars columns you want to use. For details of each type, refer to Numbers Bars Background Types.

- Configure the Column # Background Coloring Method for each of the 3 Numbers Bars columns you want to use. For details of each method, refer to Numbers Bars Background Coloring Methods.

Refer to Color Settings and Logic for Numbers Bars for descriptions of the various color settings that are used with these Background Coloring Methods. - Configure additional Numbers Bars Inputs as required. For detailed descriptions for each of the available Inputs, refer to Input Settings for Numbers Bars.

- Press OK. Press OK.

- You will now see the Numbers Bars on the chart so long as the necessary historical data is available. This requires historical tick by tick data with Bid Trade Volume and Ask Trade Volume. Refer to the Services That Support Bid Volume and Ask Volume section to know what Data or Trading services have the proper historical data for Numbers Bars.

- Due to the nature of Numbers Bars you probably will have to change the horizontal and vertical scaling to get a readable view. Refer to the Scaling a Numbers Bars Chart section for instructions. This is a very important step that must not be overlooked.

- To change the the Font, Font Style, and Font Size refer to the Font Size and Style for Numbers Bars section.

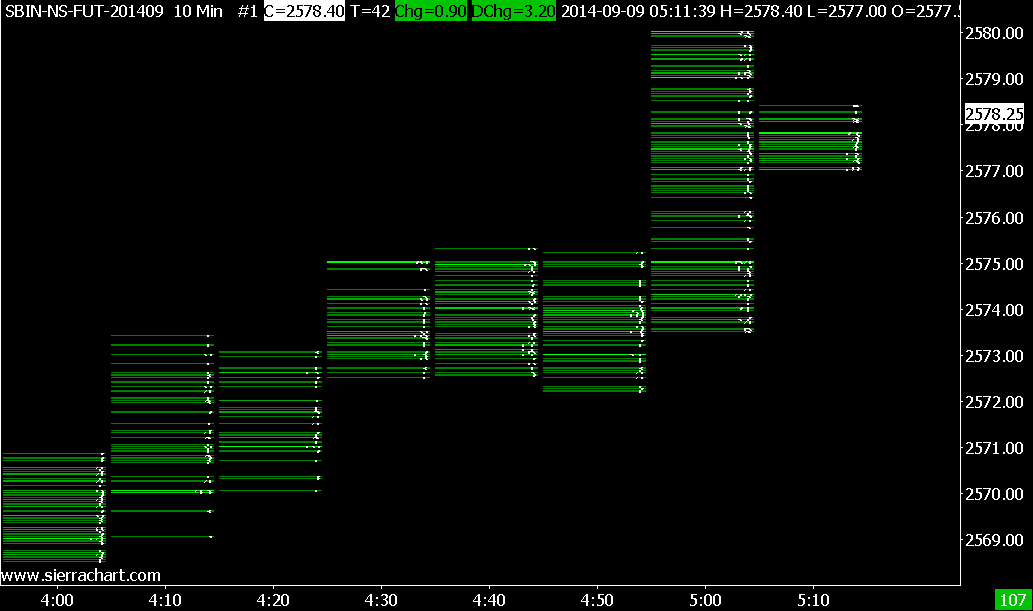

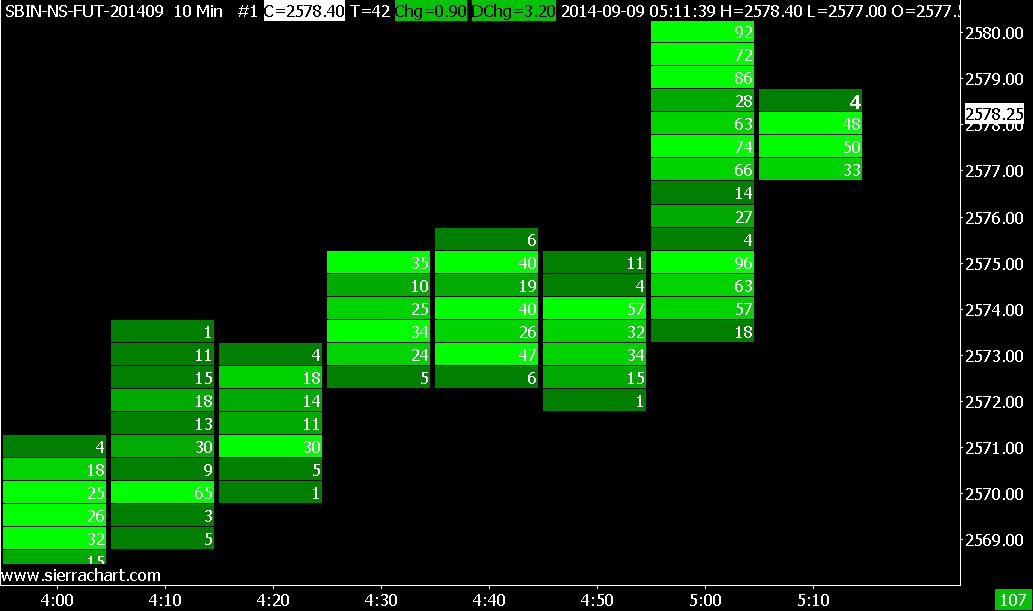

Example Numbers Bars Chart

To help get started with using Numbers Bars, Sierra Chart has created an example Chartbook that contains a chart with the Numbers Bars and Numbers Bars Calculated Values studies.

This Chartbook can be used to help get started with the use of the Numbers Bars and to help understand how the various Inputs to the studies can be used to highlight different sets of values.

To use this Chartbook, follow these instructions:

- Left-click on the following link to access the file: NumbersBarsExampleChartbook.cht.

- Your Operating System should prompt you for where you want to save the file. It needs to be saved to the Sierra Chart Data Files Folder. To determine the location of the Data Files Folder, select Global Settings >> General Settings. Look in the Data Files Folder box. This is where you need to save the Chartbook file from your web browser.

- Go to Sierra Chart and select File >> Open Chartbook.

- Select the NumbersBarsExampleChartbook.cht Chartbook and press the Open button.

- Select Chart >> Chart Settings and enter an appropriate symbol in the Symbol box, or select the Find button to open the Find Symbol window and select an appropriate symbol from that window.

Scaling a Numbers Bars Chart

Due to the nature of Numbers Bars charts you probably will have to change the horizontal and vertical scaling to avoid the numbers in the Numbers Bars from overlapping (refer to image below), or to get the visual appearance that you require. Follow these instructions below.

- Select Chart >> Chart Settings >> Scale >> [Scale] button. Make sure the Scale Range Type is set to Automatic. This step is not necessary unless you have previously changed the Scale.

- Confirm that the Scale Range Type for the Numbers Bars study is set to Automatic. To do this, refer to Opening the Scale Window For a Study documentation. This step is not necessary unless you have previously changed the Scale for this study.

- Right-click on the Values Scale of numbers on the right side of the chart and select Reset.

- Increase the chart bar/column spacing (horizontal scaling) by pressing the Control Bar button that increases the spacing between the bars in the chart until you get a clear view of the numbers.

These are all of the available Control Bar buttons that change bar spacing: . You can also press the Up Arrow key on your keyboard. For complete instructions, refer to the Changing Spacing documentation on the Working With Charts page.

. You can also press the Up Arrow key on your keyboard. For complete instructions, refer to the Changing Spacing documentation on the Working With Charts page.

Alternatively, reduce the bar spacing in the chart if the Numbers Bars columns are to far apart which will cause the Numbers Bars columns to be too wide. - Right-click on the Values Scale on the right of the chart and select Interactive Scale Range. If necessary click and drag down on the Values Scale to expand the chart so that the numbers within the bars are easier to view. When you do this, it will cause the Numbers Bars to be expanded beyond the top and bottom of the chart.

What you can then do in this case is move the chart up and down to see all of the bars. To do this, right click on the Values Scale on the right and select Interactive Scale Move. You can then click and drag on the Values Scale to move the chart up and down. For additional information about these types of scale changes, refer to the Interactive Scaling documentation. - Once you get a reasonable view of the Numbers Bars, the next step is to choose the most appropriate font for the chart. Refer to Font Size and Style for Numbers Bars.

- You may want to save the Chartbook by selecting File >> Save.

Adjusting Tick Size For Larger Increment

In this image below, we see Numbers Bars that have overlapping price levels because the range of prices displayed contains a large number of price levels based upon the chart Tick Size.

There is insufficient space to clearly display each price level without overlapping. One effect of overlapping price levels is sometimes based upon the density of those levels, that nothing appears at all for some price levels.

In the case of a severe overlap like we see above, the solution to this is to increase the Tick Size in Chart >> Chart Settings >> Symbol. For example, it can be increased by 4 to 10 times or higher. Even 100 times may be necessary. In this particular case, we have increased it by 10 times. See the result below.

Another solution is to right-click on the Values Scale on the right side of the chart and select Interactive Scale Range. Left click and drag down on the Values Scale to expand the chart so that the numbers within the bars are easier to view. When you do this, it will cause the Numbers Bars to be expanded beyond the top and bottom of the chart.

What you can then do in this case is move the chart up and down to see the top and bottom of the chart bars. To do this, right click on the Values Scale on the right of the chart and select Interactive Scale Move. Left click and drag on the Values Scale to move the chart up and down. For additional information , refer to the Interactive Scaling documentation.

Another solution you could use is to increase the Volume at Price Multiplier in Chart >> Chart Settings.

Numbers Bars Text Types

This section describes the Column # Numbers Bars Text study Input. This Input setting determines the specific text which is displayed at each price level within a Numbers Bar.

For instructions to modify the Column # Numbers Bars Text Input, refer to the Step-By-Step Instructions.

- No Text: When No Text is selected, then there is no Numbers Bar column displayed.

- Ask Vol Bid Vol Difference (AskVolume BidVolume Difference): This Numbers Bars Text type displays the difference between AskVolume and BidVolume for each price within the Numbers Bar.

- Volume: This Numbers Bars Text type displays the Total Volume for each price within the Numbers Bar.

- Trades: This Numbers Bars Text type displays the Number of Trades for each price within the Numbers Bar.

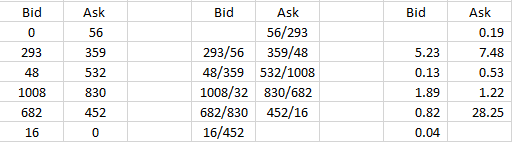

- Bid Vol x Ask Vol (Bid Volume by Ask Volume): This Numbers Bars Text type displays the Bid Volume and Ask Volume separated by an x, |, space, or two spaces character(s), for each price within the Numbers Bar.

- Dominant Side Volume Percent: This Numbers Bars Text type displays a percentage and it is calculated as follows:

When Ask Volume is greater than the Bid Volume at a price level within the Numbers Bar, then this will be a positive percentage. This percentage represents what the Ask Volume is percentagewise of the sum of the Ask Volume and Bid Volume for the price level within the Numbers Bar.

When Bid Volume is greater than the Ask Volume at a price level within the Numbers Bar, then this will be a negative percentage. This percentage represents what the Bid Volume is percentagewise of the sum of the Ask Volume and Bid Volume for the price level within the Numbers Bar. - Price: This Numbers Bars Text displays the actual price for each price within the Numbers Bar.

- Ask Vol Bid Vol Difference Diagonal (Ask Volume Bid Volume Difference Diagonal): This Numbers Bars Text type displays 2 values at each price level.

Left Value: Ask Volume at Next Price level - Bid Volume at Price level.

Right Value: Ask Volume at Price level - Bid Volume at Previous Price level.

In the case where there is a comparison to a Bid or Ask level which does not exist above or below the Numbers Bar, then the resulting value is 0.

It may be useful to display the Bid Vol x Ask Vol Text Type in a second Numbers Bars column by setting the Column 2 Numbers Bars Text Input to this Text Type. - Ask Vol Bid Vol Diff Diagonal Bid Side: This Numbers Bars Text Type displays the Diagonal Difference of the Bid side for each price level. That is, it displays the Ask Volume at the next higher price level minus the Bid Volume at the current price level.

- Ask Vol Bid Vol Diff Diagonal Ask Side: This Numbers Bars Text Type displays the Diagonal Difference of the Ask side for each price level. That is, it displays the Ask Volume at the price level minus the Bid Volume at the next lower price level.

- Ask Vol Bid Vol Diff Diagonal Dominant Side: This Numbers Bars Text Type displays the dominant side Diagonal Difference for each price level. That is, if the Bid side Diagonal Difference is greater than the Ask side Diagonal Difference, then the Bid side Diagonal Difference is displayed. If the Ask side Diagonal Difference is greater than or equal to the Bid side Diagonal Difference, then the Ask side Diagonal Difference is displayed. If neither side is dominant at a price level, a value of zero is displayed.

When the Input for Enable Diagonal Bid/Ask Compare with No Data at High/Low is set to Yes and if a dominant side is determined based on this setting, then that value will be displayed at the High or Low.

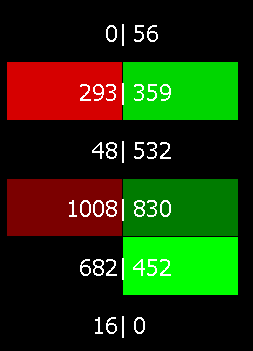

Numbers Bars Background Types

This section describes the Column # Background Type study Input. These settings affect how the background of a price level within a Numbers Bar is filled in.

For instructions to modify the Column # Background Type Input, refer to the Step-By-Step Instructions.

- Full Background: This background type fills the entire background of a price level within a Numbers Bar.

- Background on Dominant Side (Supports Separate Bid and Ask Coloring): The functioning of this background type is affected by the Numbers Bars Background Coloring Methods. This background type fills 50% of the background of a price level within a Numbers Bar, either the Bid Side, Ask Side or both, depending on which side is the dominant side.

This setting is only meaningful if the Column # Background Coloring Method is set to one of the Dominant Side or Diagonal Dominant Side Coloring Methods. - Background on Dominant Side Outline: (Supports Separate Bid and Ask Coloring): The functioning of this background type is affected by the Numbers Bars Background Coloring Methods. This background type outlines 50% of a price level within a Numbers Bar, either the Bid Side, Ask Side or both, depending on which side is the dominant side.

This setting is only meaningful if the Column # Background Coloring Method is set to one of the Dominant Side or Diagonal Dominant Side Coloring Methods. - Volume Profile: This background type fills the background for a price level based upon the volume at the price level compared to the maximum volume among all of the price levels within the Numbers Bar.

- Volume Profile Outline: This is identical to Volume Profile , except that only an outline is drawn instead of filling the price level.

- Right Aligned Volume Profile: This is identical to Volume Profile , except that the Volume Profile fill is right aligned.

- Right Aligned Volume Profile Outline: This is identical to Volume Profile, except that only an outline is drawn instead of filling the price level and this outline is right outlined

- Ask Bid Difference Profile: This background type will calculate the difference between Ask Volume and Bid Volume and color the width of the background of the price levels within the Numbers Bar based upon this difference, relative to the maximum difference. This will give a Volume Profile appearance.

When highlighting the Point of Control, the price level with the greatest volume may not necessarily be the largest vertical bar based upon this background type. - Ask Bid Difference Profile Outline: This is identical to the Ask Bid Difference Profile, except that only the outline of the volume difference profile is drawn, instead of filling the price level.

- Right Aligned Ask Bid Difference Profile: This is identical to Aask Bid Difference Profile, except that the volume difference profile is right aligned.

- Right Aligned Ask Bid Difference Profile Outline: This is identical to Ask Bid Difference Profile, except that only the outline of the volume difference profile is drawn, instead of filling the price level and the volume difference is right aligned.

- Ask/Bid Volume Split Profile (Supports Separate Bid and Ask Coloring): This background type draws separate Volume Profiles for Bid volume and Ask volume. The Bid volume is on the left side and the Ask volume is on the right side. The base of the Volume Profiles is along the center of the Numbers Bar.

Both the Ask and Bid Volume profiles are built independently. The profile widths are built by looking at the percentage of the Bid Volume/Ask Volume versus the maximum Bid Volume/Ask Volume depending on whether the profile is for Bid Volume or Ask Volume. - Ask/Bid Volume Split Profile Outline (Supports Separate Bid and Ask Coloring): This is identical to the Ask/Bid Volume Split Profile except only the outline of the Volume Profiles are drawn, instead of filling the price level.

- Volume Profile Across All Columns: This background type is identical to the Volume Profile background type except that the bars extend across all the Numbers Bars columns if you are using more than one column per price bar.

- Volume Profile Outline Across All Columns: This is identical to the Volume Profile Across All Columns, except that only an outline is drawn for the Volume Profiles, instead of filling the price level.

- Ask/Bid Volume Split Profile Across Bid & Ask (Supports Separate Bid and Ask Coloring): This background type is similar to Ask/Bid Volume Split Profile, however it uses the maximum value across price levels for both the Bid and Ask sides to determine the bar widths.

- Ask/Bid Volume Split Profile Across Bid & Ask Outline (Supports Separate Bid and Ask Coloring): Same as Ask/Bid Volume Split Profile Across Bid & Ask, except that only an outline is drawn for the Volume Profiles, instead of filling in the price level.

Numbers Bars Background Coloring Methods

This section documents the Column # Background Coloring Method study Input. The Background Coloring Method controls the application of colors to each price level within the Numbers Bar. There are multiple formulas to choose from. They are documented below.

For instructions to modify the Column # Background Coloring Method Input, refer to the Step-By-Step Instructions.

- None (Transparent): This setting means there is no background coloring for each price level in the Numbers Bar. The text will be displayed directly on the chart background color.

- Based on Volume Percentage: This setting uses the Volume at Price in comparison to the maximum value of volume across all prices for the bar. Refer to the Background Coloring Based On Volume Percentage Color Settings and Logic section for more information.

- Based on Trades Percentage: This setting uses the Trades at Price versus the maximum value of trades across all prices for the bar. Refer to the Background Coloring Based On Trades Percentage Color Settings and Logic section for more information.

- Based on AskVol/BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the maximum value of Ask or Bid volume across all prices for the bar. Refer to the Background Coloring Based On AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Dominant AskVol BidVol To Volume at Price Percentage: This setting uses the Ask or Bid volume at Price versus the total volume at Price. Refer to the Background Coloring Based on Dominant AskVol BidVol to Volume at Price Percentage Color Settings and Logic section for more information.

- Based on Above/At or Below Last: This setting uses the current price versus the Last price. Refer to the Background Coloring Based on Above/At or Below Last Color Settings and Logic section for more information.

- Based on Dominant Side AskVol BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the Bid or Ask Volume at Price. Refer to the Background Coloring Based on Dominant Side AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant Side AskVol BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the Previous Bid or Next Ask Volume at Price. Refer to the Background Coloring Based on Diagonal Dominant Side AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage: This setting uses the Bid or Ask Volume at Price versus the total of diagonal Bid and Ask Volume. Refer to the Background Coloring Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant AskVol BidVol Difference - Actual: This setting uses the Ask Volume at Price minus the Bid Volume at the previous price. Refer to the Background Coloring Based on Diagonal Dominant AskVol BidVol Difference - Actual Color Settings and Logic section for more information.

- Based on AskVol BidVol Diagonal Difference Percentage of Bar Range: This setting uses the volume difference between the Ask or Bid Volume at Price and the Bid or Ask Volume at the previous or next price divided by the range of diagonal volumes within the bar. Refer to the Background Coloring Based on AskVol BidVol Diagonal Difference Percentage of Bar Range Color Settings and Logic section for more information.

- Based on Volume - Actual: This setting uses the volume at price. Refer to the Background Coloring Based on Volume - Actual Color Settings and Logic section for more information.

- Based on Trades - Actual: This setting uses the trades at price. Refer to the Background Coloring Based on Trades - Actual Color Settings and Logic section for more information.

- Based on Dominant AskVol BidVol - Actual: This setting uses the Ask Volume or Bid Volume at price. Refer to the Background Coloring Based on Dominant AskVol BidVol - Actual Color Settings and Logic section for more information.

- Based on AskVol BidVol Difference - Actual: This setting uses the difference of the Ask volume at price to the Bid volume at price. Refer to the Background Coloring Based on AskVol BidVol Difference - Actual Color Settings and Logic section for more information.

- Based on Separate Ask Volume Bid Volume - Actual: This setting uses the Ask Volume or Bid Volume at price and allows for separate coloring of the Ask Volume and Bid Volume. Refer to the Background Coloring Based on Separate Ask Volume Bid Volume - Actual Color Settings and Logic section for more information.

- Based on Separate Diagonal AskVol BidVol Percentage: This setting uses the diagonal comparison of Bid and Ask to determine dominance, and displays the coloring range based on a particular side Ask or Bid volume at price compared to the largest Ask or Bid volume within the bar to give a percentage of Ask or Bid volume. Refer to the Background Coloring Based on Separate Diagonal AskVol BidVol Percentage Color Settings and Logic Section for more information.

- Based on Separate AskVol/BidVol Percentage: This setting uses the Ask Volume or Bid Volume at a price level in comparison to the largest Ask Volume or Bid Volume across all prices to give a percentage of Ask or Bid Volume and allows for separate coloring of the Ask Volume and Bid Volume based on this percentage. Refer to the Background Coloring Based on Separate AskVol/BidVol Percentage Color Settings and Logic Section for more information.

- Based on Dominant Total Volume - Actual: This setting uses a comparison at a price level to determine dominance and then displays the coloring range based on the total volume at that price level. Refer to the Background Coloring Based on Dominant Total Volume - Actual Color Settings and Logic Section for more information.

- Based on AskVol BidVol Difference Percentage of Max Dominant Side: This setting uses a comparison of the Ask Volume minus Bid Volume (Delta) at a price level in comparison to the largest Delta in the entire bar for the dominant side at that price level. Refer to the Background Coloring Based on AskVol BidVol Difference Percentage of Max Dominant Side Color Settings and Logic Section for more information.

- Based on Diagonal Dominant AskVol BidVol - Actual: This setting uses the diagonal comparison of Bid and Ask to determine dominance, and displays the coloring range based on the actual value of Bid or Ask volume at that price level. Refer to the Background Coloring Based on Diagonal Dominant ASkVol BidVol - Actual Color Settings and Logic Section for more information

In order to view the data that drives the coloring of Numbers Bars that reference Dominant or Diagonal, set the Column # Numbers Bars Text to BidVol x AskVol. Refer to section Text Types for more information.

Numbers Bars Text Coloring Methods

This section describes the Column # Text Coloring Method study Input. The Text Coloring Method controls the coloring of the text at each price level within the Numbers Bar.

The coloring of the Numbers Bars Text is dependent on the Use Separate Colors for Text Coloring Method Input setting. When this is set to Yes, the Numbers Bars Text coloring will use the Range # Up Color for Text or Range # Down Color for Text as appropriate. This allows the text to be seen on top of any background coloring that may be used for the Numbers Bar.

For instructions to modify the Column # Text Coloring Method Input, refer to the Step-By-Step Instructions.

- None (Transparent): This setting means there is no special text coloring for each price level in the Numbers Bar. The Default Text Color Input setting controls the color of the text.

- Based on Volume Percentage: This setting uses the Volume at Price in comparison to the maximum value of volume across all prices for the bar. Refer to the Text Coloring Based On Volume Percentage Color Settings and Logic section for more information.

- Based on Trades Percentage: This setting uses the Trades at Price versus the maximum value of trades across all prices for the bar. Refer to the Text Coloring Based On Trades Percentage Color Settings and Logic section for more information.

- Based on AskVol/BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the maximum value of Ask or Bid volume across all prices for the bar. Refer to the Text Coloring Based On AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Dominant AskVol BidVol To Volume at Price Percentage: This setting uses the Ask or Bid volume at Price versus the maximum volume across all prices for the bar. Refer to the Text Coloring Based on Dominant AskVol BidVol to Volume at Price Percentage Color Settings and Logic section for more information.

- Based on Above/At Below Last: This setting uses the current price versus the Last price. Refer to the Text Coloring Based On Above/At Below Last Color Settings and Logic section for more information.

- Based on Dominant Side AskVol BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the Bid or Ask Volume at Price. Refer to the Text Coloring Based on Dominant Side AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant Side AskVol BidVol Percentage: This setting uses the Ask or Bid volume at Price versus the Previous Bid or Next Ask Volume at Price. Refer to the Text Coloring Based on Diagonal Dominant Side AskVol BidVol Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage: This setting uses the Bid or Ask Volume at Price versus the maximum value of Bid and Ask Volume. Refer to the Text Coloring Based on Diagonal Dominant AskVol BidVol to Volume at Price Percentage Color Settings and Logic section for more information.

- Based on Diagonal Dominant AskVol BidVol Difference - Actual: This setting uses the Ask Volume at Price minus the Bid Volume at the previous price. Refer to the Text Coloring Based on Diagonal Dominant AskVol BidVol Difference - Actual Color Settings and Logic section for more information.

- Based on AskVol BidVol Diagonal Difference Percentage of Bar Range: This setting uses the volume difference between the Ask or Bid Volume at Price and the Bid or Ask Volume at the previous or next price divided by the range of diagonal volumes within the bar. Refer to the Text Coloring Based on AskVol BidVol Diagonal Difference Percentage of Bar Range Color Settings and Logic section for more information.

- Based on Volume - Actual: This setting uses the volume at price. Refer to the Text Coloring Based on Volume - Actual Color Settings and Logic section for more information.

- Based on Trades - Actual: This setting uses the trades at price. Refer to the Text Coloring Based on Trades - Actual Color Settings and Logic section for more information.

- Based on Dominant AskVol BidVol - Actual: This setting uses the Ask Volume or Bid Volume at price. Refer to the Text Coloring Based on Dominant AskVol BidVol - Actual Color Settings and Logic section for more information.

- Based on AskVol BidVol Difference - Actual: This setting uses the difference of the Ask volume at price to the Bid volume at price. Refer to the Text Coloring Based on AskVol BidVol Difference - Actual Color Settings and Logic section for more information.

- Based on Separate Ask Volume Bid Volume - Actual: This setting uses the Ask Volume or Bid Volume at price and allows for separate coloring of the Ask Volume and Bid Volume. Refer to the Text Coloring Based on Separate Ask Volume Bid Volume - Actual Color Settings and Logic section for more information.

- Based on Separate Diagonal AskVol BidVol Percentage: This setting uses the diagonal comparison of Bid and Ask to determine dominance, and displays the coloring range based on a particular side Ask or Bid volume at price compared to the largest Ask or Bid volume within the bar to give a percentage of Ask or Bid volume. Refer to the Text Coloring Based on Separate Diagonal AskVol BidVol Percentage Color Settings and Logic Section for more information.

- Based on Separate AskVol/BidVol Percentage: This setting uses the Ask Volume or Bid Volume at a price level in comparison to the largest Ask Volume or Bid Volume across all prices to give a percentage of Ask or Bid Volume and allows for separate coloring of the Ask Volume and Bid Volume based on their percentage. Refer to the Text Coloring Based on Separate AskVol/BidVol Percentage Color Settings and Logic Section for more information.

- Based on Dominant Total Volume - Actual: This setting uses a comparison at a price level to determine dominance and then displays the coloring range based on the total volume at that price level. Refer to the Text Coloring Based on Dominant Total Volume - Actual Color Settings and Logic Section for more information.

- Based on AskVol BidVol Difference Percentage of Max Dominant Side: This setting uses a comparison of the Ask Volume minus Bid Volume (Delta) at a price level in comparison to the largest Delta in the entire bar for the dominant side at that price level. Refer to the Text Coloring Based on AskVol BidVol Difference Percentage of Max Dominant Side Color Settings and Logic Section for more information.

Using Text and Background Coloring Methods at Same Time

It is supported to use both a Numbers Bars Text Coloring Method and the Numbers Bars Background Coloring Method for the same Numbers Bars column at the same time.

To do this, it is necessary to use separate coloring for the Text Coloring Method to distinguish the text coloring from the background coloring, which can be accomplished through the Use Separate Colors for Text Coloring Method and the Range # Up/Down Color for Text Inputs.

Text Not Appearing

If you are using both a Background Coloring Method and a Text Coloring Method at the same time and you no longer see the text displayed within the Numbers Bars either completely or in some places, then make sure to set the Use Separate Colors for Text Coloring Method Input to Yes.

And make sure to set different colors for the Range # Up/Down Color for Text Inputs compared to the Column # Range Up/down Color Input colors.

Input Settings for Numbers Bars

This section documents the study Input settings for the Numbers Bars study. For instructions to modify these Input settings, refer to the Step-By-Step Instructions.

Column # Numbers Bars Text

Refer to Numbers Bars Text Types.

Column # Background Type

Refer to Numbers Bars Background Types.

Column # Background Coloring Method

Refer to Numbers Bars Background Coloring Methods.

Column # Text Coloring Method

Refer to Numbers Bars Text Coloring Methods.

Column # Range 3 Up Color

Column # Range 2 Up Color

Column # Range 1 Up Color

Column # Range 0 Up Color

Column # Range 0 Down Color

Column # Range 1 Down Color

Column # Range 2 Down Color

Column # Range 3 Down Color

Pullback Column # Numbers Bars Text

Refer to Numbers Bars Text Types.

Pullback Column # Background Type

Refer to Numbers Bars Background Types.

Pullback Column # Background Coloring Method

Refer to Numbers Bars Background Coloring Methods.

Pullback Column # Text Coloring Method

Refer to Numbers Bars Text Coloring Methods.

Default Text Color

This Input controls the text color of the displayed values within each price level of a Numbers Bar. This Input only applies when the Column # Text Coloring Method is set to None.

Color Non-Dominant Ask/Bid Text Same as Opposing Side

This Input controls the coloring of non-dominant Ask/Bid text coloring when the Numbers Bars Text is displayed as Bid Vol x Ask Vol.

When this Input is set to Yes then the non-dominant Ask or Bid text, which would be colored the Default Text Color would instead be colored the same color as the opposing (same price) Bid/Ask text color. This coloring is always done at the same price level even when the Dominant determination is performed diagonally.

Highlight Minimum Value In

This Input controls the specific Numbers Bar column within the 3 available columns for underlying bar in the chart, where the highlighting of the minimum value at a price level, will be drawn.

The Highlight Maximum/Minimum Value Based On Input controls specifically what is highlighted.

When the Highlight Maximum/Minimum Value Based On Input is set to Bid Volume, Ask Volume, or Bid or Ask Volume, and there is a value of 0 within the bar for the particular volume type, then no highlight box will be drawn.

Minimum Highlight Color

This Input controls the color of the minimum value highlight.

Minimum Highlight Line Width

This Input controls the line width of the minimum value highlight.

Highlight Maximum Value In

This Input controls the specific Numbers Bar column within the 3 available columns for underlying bar in the chart, where the highlighting of the maximum value at a price level, will be drawn.

The Highlight Maximum/Minimum Value Based On Input controls specifically what is highlighted.

Maximum Highlight Color

This Input controls the color of the maximum value highlight.

Maximum Highlight Line Width

This Input controls the line width of the maximum value highlight.

Highlight Point Of Control In

This Input controls the specific Numbers Bar column within the 3 available columns for underlying bar in the chart, where the highlighting of the Point of Control, will be drawn. The Point of Control in a Numbers Bar is the price level where there is the greatest volume among all of the other price levels. The point of control is highlighted by drawing a rectangle around the price level.

There are six options available for where to draw the Point of Control Highlight:

- No Columns: This will not display the Point of Control Highlight.

- Column 1: This will display the Point of Control Highlight on the data in Column 1.

- Column 2: This will display the Point of Control Highlight on the data in Column 2.

- Column 3: This will display the Point of Control Highlight on the data in Column 3.

- All Columns: This will display the Point of Control Highlight on the data in all columns that are shown.

- Column 1 with Extension Line Until Future Intersection: This will display the Point of Control Highlight on the data in Column 1 and will also display a line extending to the right from the Point of Control location until it intersects with another bar at the same price.

- The Color, Line Style, and Width of the extension line can be controlled or modified on the Subgraph tab of the Numbers Bars Study page. Select the Line - POC Extension Lines Until Future Intersection subgraph and select the Color, Line Style, or Width/Size options to change the selected parameter.

Point Of Control Highlight Color

This Input controls the color of the highlighting of the price level which is the Point of Control.

Point Of Control Highlight Line Width

This Input controls the line width of the Point of Control highlight line.

Highlight Equal Bid and Ask Volumes In

This Input controls the specific Numbers Bar column within the 3 available columns for underlying bar in the chart, where the highlighting of Equal Bid and Ask Volumes will be drawn. Wnen enabled, the highlighting is done by drawing a rectangle around the price level.

This highlighting will only display, regardless of the setting for this Input, when the Column n Numbers Bars Text is set to Bid x Ask.

There are five options available for where to draw the Equal Bid and Ask Volumes Highlight:

- No Columns: This will not display the Equal Bid and Ask Volumes Highlight.

- Column 1: This will display the Equal Bid and Ask Volumes Highlight on the data in Column 1.

- Column 2: This will display the Equal Bid and Ask Volumes Highlight on the data in Column 2.

- Column 3: This will display the Equal Bid and Ask Volumes Highlight on the data in Column 3.

- All Columns: This will display the Equal Bid and Ask Volumes Highlight on the data in all columns that are shown.

Equal Bid and Ask Volumes Highlight Color

This Input controls the color of the Equal Bid and Ask highlighting of the price level when this highlighting is displayed.

Equal Bid and Ask Volumes Line Width

This Input controls the line width of the Equal Bid and Ask highlight line when this highlighting is displayed.

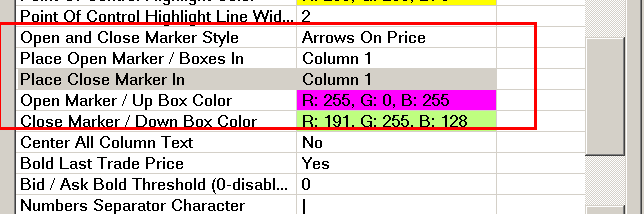

Open and Close Marker Style

This setting is for specifying the Open and Close marker style for a Numbers Bar. This controls the style of the marker indicating the Open price and the Close price of a Numbers Bar. It can be set to one of the following in the list below.

In the case of a Renko bar chart, the Open and Close represent the Renko Open and Close and not the true Open and Close of the bar. For more information, refer to Renko Open High Low Close Values.

In the case of when using Point and Figure XO Graph Draw Type for a chart, this will affect the display of the Open and Close Marker Style. Therefore, you should use Candlestick instead.

None

There is no style for the Open and Close Marker.

Arrows On Price

This setting will show arrows on the Numbers Bar price levels which indicate the Open and Close price. The arrow that is on the left side, represents the price of the Open for the bar. The arrow that is on the right side, represents the price of the Close for the bar.

Vertical Bars On Price

This setting will show narrow vertical bars on the Numbers Bar price levels which indicate the Open and Close price. The vertical bar that is on the left side, represents the price of the Open for the bar. The vertical bar that is on the right side, represents the price of the Close for the bar.

Open To Close Boxes

This setting will draw boxes from the Open price to the Close price of the Numbers Bar, along the left side of the Numbers Bar. The box coloring is set with the Open Marker / Up Box Color (for Up bars) and the Close Marker / Down Box Color (for Down bars) Color Input settings.

When choosing this option, you only need to set Place Open Marker / Boxes In to Column 1 or to whichever Numbers Bar column you want to display the boxes in. Since the boxes are only displayed on one side of the column the Place Close Marker setting is not used.

Candlestick Body Filled

This setting will draw a filled candlestick body from the Open price to the Close price using the Open Marker / Up Box Color for up bars and Close Marker / Down Box Color for down bars. Due to overlapping information, it is not recommended to use this option in combination with a Background Coloring.

The determination of whether a Candlestick bar is an up bar or a down bar uses the very same logic which is used with coloring Candlestick bars. Refer to How Chart Bar and Candlestick Up/Down is Determined.

Candlestick Body Outline

This setting will draw a candlestick body outline from the Open price to the Close price using the Open Marker / Up Box Color for up bars and Close Marker / Down Box Color for down bars.

The determination of whether a Candlestick bar is an up bar or a down bar uses the very same logic which is used with coloring Candlestick bars. Refer to How Chart Bar and Candlestick Up/Down is Determined.

Candlestick Outline

This setting will draw a full candlestick outline with a line from the High price to the Low price of the bar. And a candlestick body from the Open price to the Close price of the bar. The Open Marker / Up Box Color color is used for up bars and Close Marker / Down Box Color for down bars.

The determination of whether a Candlestick bar is an up bar or a down bar uses the very same logic which is used with coloring Candlestick bars. Refer to How Chart Bar and Candlestick Up/Down is Determined.

After choosing one of the Open and Close Marker Style settings other than None, it is necessary to specify the particular column to draw the markers in. Set the Place Open Marker / Boxes In and Place Close Marker In to the particular column # that you want the markers displayed in.

The Colors for the Arrows and Vertical Bars are set with the Open Marker/ Up Box Color and the Close Marker / Down Box Color Color Input settings. Refer to image below.

In the case of Renko bars, the Open and Close for the Marker Style use the Renko Open and Renko Close. For additional information, refer to Renko Open, High, Low, Close Values.

Place Open Marker / Boxes In

This Input controls which Numbers Bar column among the 3 available columns, the Open marker or Open to Close boxes will be drawn in.

Place Close Marker In

This Input controls which Numbers Bar column among the 3 available columns, the Close marker will be drawn in. This does not apply when using Open to Close Boxes.

Open Marker / Up Box Color

This color Input sets the Open Marker color, or the Open to Close boxes color for when a bar is an up bar.

Close Marker / Down Box Color

This color Input sets the Close Marker color, or the Open to Close boxes color for when a bar is a down bar.

Single Value Text Alignment

This Input controls the text alignment when a single text value is displayed within a Numbers Bar. The available options are Right, Center, and Left. When the Column # Numbers Bars Text is set to Bid Volume x Ask Volume, then the text is always centered.

Bold/Highlight Last Trade Price

This Input has the following options that control how the text is displayed in the last bar in relation to the last trade:

- None: The text is not displayed any differently due to the status of the last trade.

- Bold Only: The text is displayed as a bold font at the price level of the last trade. When the Numbers Bars Text is set to display both the Bid and Ask volumes, then if the last trade was at the Bid, then the Bid text is bolded, whereas if the last trade was at the Ask, then the Ask text is bolded.

- Highlight Only: The text is displayed with a background color at the price level of the last trade. The particular background color is determined by whether the last trade was at the Bid or at the Ask and then uses the respective Last Trade Bid Highlight Color or Last Trade ASk Highlight Color. When the Numbers Bars Text is set to display both the Bid and Ask Volumes, then if the last trade was at the Bid, then the Bid text is highlighted, whereas if the last trade was at the Ask, then the Ask text is highlighted.

- Bold and Highlight: The text is displayed with both a bold font and a background color at the price lvel of the last trade. The particular background color is determined by whether the last trade was at the Bid or at the Ask and then uses the respective Last Trade Bid Highlight Color or Last Trade ASk Highlight Color and bold font. When the Numbers Bars Text is set to display both the Bid and Ask Volumes, then if the last trade was at the Bid, then the Bid text is highlighted and bolded, whereas if the last trade was at the Ask, then the Ask text is highlighted and bolded.

Last Trade Bid Highlight Color

This Input controls the color of the Bid highlight when the Bold/Highlight Last Trade Price is set to either Highlight Only or Bold and Highlight.

Last Trade Ask Highlight Color

This Input controls the color of the Ask highlight when the Bold/Highlight Last Trade Price is set to either Highlight Only or Bold and Highlight.

Bid / Ask Bold Threshold

This Input sets a volume level, which when exceeded by a Bid Volume or Ask Volume value, will cause a bold font to be used to display that value. This setting only applies when the Column # Numbers Bars Text is set to Bid Vol x Ask Vol.

Numbers Separator Character

This Input sets the separator character used between the Bid Volume and the Ask Volume when the Numbers Bars Text Type is set to Bid Volume x Ask Volume.

Font Size Mode

This sets how the font size for the Numbers Bars is determined. The font type used is the same as is set for the Chart Text Font. The following options are available:

- Same As Chart Font: When this option is selected, then the font size that is used for the Numbers Bars is the same as the selected Chart Text Font size.

- Automatic with Minimum/Maximum Limits: When this option is selected, then the font size that is used for the Numbers Bars will vary, based on the spacing of the numbers bars. The font size will not be larger than the value set in Maximum Font Size for Automatic Font Size and it will not be smaller than the value set in Minimum Font Size for Automatic Font Size.

Maximum Font Size for Automatic Font Size

This sets the largest font size that will be used for the Numbers Bars, when the Font Size Mode is set to Automatic with Minimum/Maximum Limits.

Minimum Font Size for Automatic Font Size

This sets the smallest font size that will be used for the Numbers Bars, when the Font Size Mode is set to Automatic with Minimum/Maximum Limits.

Show Historical Pullback AskVolume BidVolume Difference

When this Input is set to Yes, then the Ask Volume and Bid Volume difference since the last reset is displayed above and below each Numbers Bar. The value at the top of the bar is the Ask Volume and Bid Volume difference since the last reset from the High and the value at the bottom of the bar is the Ask Volume and Bid Volume difference since the last reset from the low.

For this setting to have an effect and actually display the Ask Volume and Bid Volume difference, it is necessary to enable the Historical Pullback Data for the chart in Chart >> Chart settings >> Chart Data. Refer to Historical Pullback Data for information about this setting and the exact meaning of the two resetting methods.

Historical High Pullback Color

This color Input sets the color of the Historical High Pullback value.

Historical Low Pullback Color

This color Input sets the color of the Historical Low Pullback value.

Historical Pullback Font Size

This Input sets the Font Size of the High/Low Historical Pullback text above/below Numbers Bars. When this is set to 0, then this means that the Font Size for the Chart Text Font set in the Graphics Settings window controls the size. Otherwise, when this is set to a nonzero number, this controls the size of the text.

Draw Historical Pullback Separator

When this Input is set to Yes, then there will be a vertical bar separator line drawn between the last Numbers Bar in the chart and the Pullback Column on the right side of the chart. This makes it clear which column is the Pullback Column.

To change the width or color of the separator line, select Analysis >> Studies to open the Chart Studies Page, select the Numbers Bars study in the Studies to Graph area, select the Settings button to open the Numbers Bars Settings page, select the Subgraphs tab, and select the Pullback Column Divider Line in the Subgraph area. Select the Colorbutton on this page to change the color of the pullback separator line. Change the value in the Width/Size control to change the width of the pullback separator line. The other options on this page do not make any changes.

Determine Maximum/Minimum Values for Coloring From

This setting determines how the maximum and minimum values are determined for the following background and text coloring options:

- Based on Volume Percentage

- Based on Trades Percentage

- Based on AskVol/BidVol Percentage

- Based on AskVol BidVol Diagonal Difference Percentage of Bar Range

- Based on Separate AskVol BidVol Percentage

- Based on AskVol BidVol Difference Percentage of Max Dominant Side

All of the other coloring options continue to work as they did previously and changing this Input will not change how they are calculated or displayed.

This Input has the following options:

- Bar Data: The maximum and minimum values that are used as the denominator in the percentage calculations are determined from the individual bar data.

- Daily Data: the maximum and minimum values that are used as the denominator in the percentage calculations are determined from the maximum and minimum values determined over the course of the trading day as defined by the Session Times.

For example, if the Background Coloring is set to Based on Volume Percentage and the largest volume for the day was 1500 and a specific bar only has a largest volume of 500, then if this Input is set to Bar Data, then that bar will perform the calculations for Volume Percentages using a denominator of 500 which will establish a 100% value within the bar. But if this Input is set to Daily Data, then that bar will only have a maximum percentage of 33.33% (500/1500). Elsewhere, the bar that contains that volume of 1500 will have the 100% value for the day.

Column # Percent Compare Thresholds

This section applies to each of the 3 Column # Percent Compare Thresholds Inputs.

The Column # Percent Compare Thresholds is a text string Input with 3 comma separated values. The default values are .25, .50, and .75. The leftmost value is considered the first comparison threshold and the rightmost value is considered the third comparison threshold.

The 3 comparison threshold values represent percentages. .01 equals 1%. So 1.0 is 100 percent.

Each of the threshold values must be separated by a comma character.

It is required that these threshold values are in ascending order from left to right. If they are not, then they will not match correctly with the color settings.

These percent compare thresholds are used to determine which of four comparison ranges a Numbers Bar value falls within. These comparison ranges correspond to the 4 Up Color and 4 Down Color settings for each Numbers Bars column.

Refer to Color Settings and Logic for Numbers Bars for detailed explanations for each Background and Text Coloring Method.

Bid/Ask Volume Text Threshold

This Input setting only applies when the Column # Numbers Bars Text Input is set to Bid Volume x Ask Volume. Only Bid Volume numbers or Ask Volume numbers that exceed this number will be displayed. The default value is 0 which means all volume values are displayed.

Bid/Ask Minimum Volume Compare Threshold

This value sets the minimum value required for Bid/Ask Volume comparisons. If the Bid and Ask Volumes that are being compared are both less than the threshold, then the compare is not performed and the resulting background/text coloring is not done for those cells. This allows small values to not be colored even though they meet the compare thresholds (i.e. B|A -> 3|1 -> 300%, but is generally not relevant). The default value is 0 which means all Bid/Ask Volume values are used in comparisons.

Enable Diagonal Bid/Ask Compare with No Data at High/Low

When this Input is set to Yes, the Bid price at the highest price level in a Numbers Bar will be compared to 0 or 1 when a diagonal comparison/calculation is being done. And the Ask price at the lowest level in a Numbers Bar will be compared to 0 or 1 when a diagonal comparison/calculation is being done. These calculations are performed by using a value of 1 when a ratio is involved and the denominator would otherwise be NULL, otherwise a value of 0 is used where 0 is a valid value.

Otherwise, when this Input is set to No, then no diagonal comparison will be performed with the Bid price at the highest price level and the Ask price at the lowest price level. Depending on the coloring choice, this would mean that these values would not be colored.

Enable Bid/Ask Ratios with Zeros as Ones

When this Input is set to Yes, then when a ratio comparison is being performed where the denominator value would be zero (0), the comparison value is changed to one (1). This allows for these comparisons to then be colored according to the selected option. Otherwise, if this Input is set to No, then no comparison will be performed and no coloring will be applied.

Highlight Maximum/Minimum Value Based On

This Input applies to the Highlight Minimum Value In and Highlight Maximum Value In Inputs. It controls what the highlighting is based upon.

The choices are:

- Automatic

- Total Volume

- Bid Volume

- Ask Volume

- Bid Volume Or Ask Volume

- Ask Volume Bid Volume Difference

- Number Of Trades

- Price

When this Input is set to Automatic, then the decision of what to base the highlighting on is performed based on the setting of the Column # Numbers Bars Text. The following table shows how this is set:

| Column # Numbers Bars Text | Highlight Maximum/Minimum Value Based On |

| None | Total Volume |

| Ask Vol Bid Vol Difference | Ask Volume Bid Volume Difference |

| Volume | Total Volume |

| Trades | Number of Trades |

| Bid Volume x Ask Volume | Bid Volume or Ask Volume |

| Dominant Side Volume Percent | Bid Volume or Ask Volume |

| Price | Price |

| Ask Vol Bid Vol Difference Diagonal | Ask Volume Bid Volume Difference |

Column # Actual Volume Compare Thresholds

This section applies to each of the 3 Column # Actual Volume Compare Thresholds Inputs.

The Column # Actual Volume Compare Thresholds is a text string Input with 3 comma separated values. The default values are 100, 200, and 300. The leftmost value is considered the first comparison threshold and the rightmost value is considered the third comparison threshold.

The 3 comparison threshold values represent actual volume or number of trades. They are not percentages.

Each of the threshold values must be separated by a comma character.

It is required that these threshold values are in ascending order from left to right. If they are not, then they will not match correctly with the color settings.

These actual volume compare thresholds are used to determine which of four comparison ranges a Numbers Bar value falls within. These comparison ranges correspond to the 4 Up Color and 4 Down Color settings for each Numbers Bars column.

Refer to Color Settings and Logic for Numbers Bars for detailed explanations for each Background and Text Coloring Method.

Candlestick Outline Width

This Input controls the line width of the Candlestick Body Outline or Candlestick Outline marker style.

Pullback Column Right Offset in Pixels

This Input controls the position of the Pullback Column in terms of offset to the right of the last displayed bar in pixels. A larger number moves the Pullback Column further to the right.

Volume Profile Bars Length Relative to All Visible Bars

This Input controls how a Numbers Bar Background Profile is displayed when using a Background Type of Volume Profile, Volume Profile Outline, Right-Aligned Volume Profile, Right-Aligned Volume Profile Outline, Ask Bid Difference Profile, Ask Bid Difference Profile Outline, Right Aligned Ask Bid Difference Profile, Right Aligned Ask Bid Difference Profile Outline, Volume Profile Across All Columns, or Volume Profile Outline Across All Columns.

This Input also applies to the Split Profiles Background Types as well.

For these Background Types, if this Input is set to Yes then the Background Profiles are displayed relative to the largest volume (or difference volume) in any bar that is currently displayed on the screen. Otherwise, the Profiles are displayed relative to the values within a given bar.

Use Separate Colors for Text Coloring Method

This Input controls how the Numbers Bar Text is displayed. When this Input is set to Yes, the Numbers Bar Text uses the colors defined in the Range # Up Color for Text and Range # Down Color for Text Input settings.

Range 3 Up Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Method value falls into the third, up color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 2 Up Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Method value falls into the second, up color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 1 Up Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the first, up color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 0 Up Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the zeroth, up color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 0 Down Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the zeroth, down color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 1 Down Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the first, down color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 2 Down Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the second, down color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Range 3 Down Color for Text

This Input controls the coloring of the text when the Column # Text Coloring Methodvalue falls into the third, down color range and the Use Separate Colors For Text Coloring Method Input is set to Yes. Refer to Color Settings and Logic for Numbers Bars for more information.

Highlight Nonzero Bid&Ask Volume at High/Low

This Input controls what Numbers Bar column among the three available columns, that a nonzero Bid Volume and Ask Volume at the High or Low of a Numbers Bar column will be highlighted. No Columns means that the highlighting is not performed.

When Column 1 with Extension Line Until Future Intersection is selected, then extension lines from the High and Low where there is nonzero Bid Volume and Ask Volume, will be drawn until they intersect with a future price.

These extension lines are not output to any Subgraph of the Numbers Bars study and therefore will not be outputted to a Sheet used by the Spreadsheet Study.

The Nonzero Bid and Ask Volume at High/Low Highlight & Extension Lines Subgraph settings control the Colors of the highlighting. There are two color settings. The first Color setting is for the High and the second Color setting is for the Low. When extension lines are selected to be drawn, this Subgraph controls the Line Style and Width.

Use the Input Highlight Nonzero Bid&Ask at High/Low Threshold to control the minimum value that both the Bid and Ask must be greater than in order to be highlighted.

Highlight Nonzero Bid&Ask at High/Low in Pullback Columns

When the Input for Highlight Nonzero Bid&Ask Volume at High/Low is set to a value other than No Columns, this Input controls whether the nonzero Bid&Ask at High/Low highlighting will also be drawn on the associated Pullback columns, if the pullback columns are displayed.