Home >> (Table of Contents) Supported Data and Trading Services >> Cryptocurrency / Bitcoin Data and Trading Services

Cryptocurrency / Bitcoin Data and Trading Services

- Introduction

- What is Included

- Setup Instructions

- Notes

- Market Depth Data

- Important (Must Read): Volume at Price Studies with Cryptocurrency Symbols

- Daily Open, High, Low, Previous Close Values

Introduction

Sierra Chart fully supports market data in the Cryptocurrency / Bitcoin markets.

Complete market data feeds from the major Cryptocurrency exchanges are supported. The data includes real-time data, market depth data, historical Daily data, and historical Intraday data.

When using certain types of studies in Sierra Chart on Cryptocurrency charts, it is essential that you read the Important (Must Read): Volume at Price Studies with Cryptocurrency Symbols section on this page.

What is Included

- Streaming Real-Time Data: Yes.

- Historical Intraday Data: Yes. BitMex data starts 2017-03-21. Binance data starts 2020-12.

- Historical Daily Data: Yes. BitMex data starts 2017-03-21. Binance data starts 2020-12.

- Historical BidVolume and AskVolume: Yes.

- Live Trading: No.

- Simulated Trading: Yes.

- Order Types Supported: All order types.

- Server Managed OCO (Order Cancels Order): No.

- Automated Trading (applies to Live or Simulated): Yes.

Setup Instructions

- If you are using Sierra Chart with a Trading service and you want to access the cryptocurrency market data separate from this installation of Sierra Chart or the cryptocurrency symbol categories are not listed as explained below, then install a second copy of Sierra Chart set to use the SC Data - All Services service.

Refer to the instructions on the Multiple Services page to install another copy/installation of Sierra Chart before continuing with the below steps. - Select Global Settings >> Data/Trade Service Settings.

- Set the Service to SC Data - All Services. You will have access to market data from the following cryptocurrency exchanges: Binance, Bitfinex, BitMEX, Deribit, FTX.

- Set the Intraday Data Storage Time Unit to what you require.

- Press OK to close the Data/Trade Service Settings window.

- Select File >> Connect to Data Feed.

- If there any connection problems, they will be displayed in Window >> Message Log. In this case, refer to Help Topic 1.

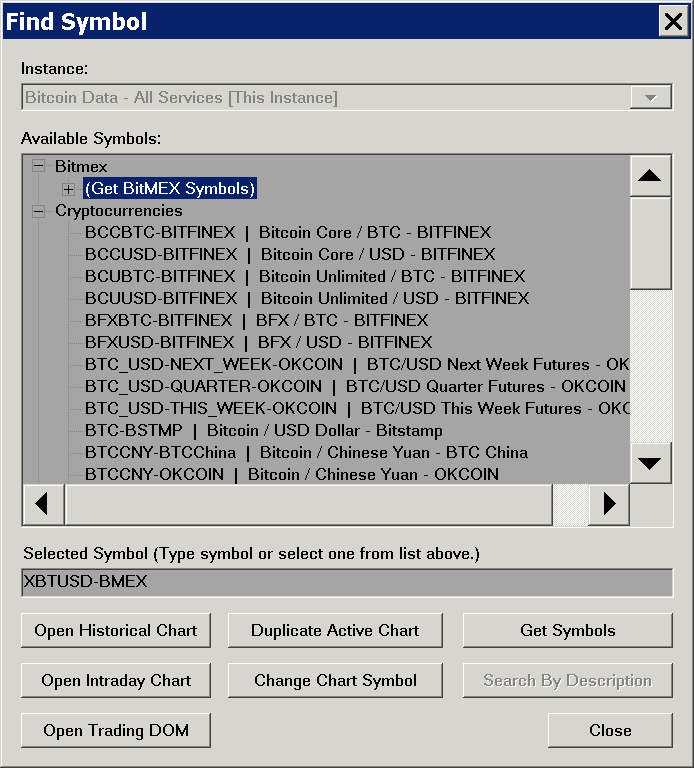

- To open a chart select File >> Find Symbol. All of the symbols can be listed through the following subcategories: Binance, Bitfinex, BitMEX, Deribit, FTX Crypto. Refer to the image below.

For all of these services, it is necessary to first get the symbols. For instructions, refer to the Get Symbols section.

Select the symbol that you want and open a Historical Chart, Intraday Chart or a Trading DOM for. - When using certain types of studies in Sierra Chart on Cryptocurrency charts, it is essential that you read the Important (Must Read): Volume at Price Studies with Cryptocurrency Symbols section on this page.

- Continue with Step 3 in the Getting Started instructions.

Notes

The volume data for the Binance crypto currency data feed is as integers only, and it represents 10,000 times the reported fractional volumes from the original Binance data feed. The reason for this is that Sierra Chart can only work with integer volume values.

Market Depth Data

To view the market depth data for a chart or Trade DOM, select Chart >> Open Market Depth Window.

In the cryptocurrencies market, there are a large number of market depth Bid and Ask levels. Many of which have very small quantities/sizes which can unnecessarily clutter the display.

In order to provide an easier to read market depth display and ensure Sierra Chart can display all of the available levels, Sierra Chart may consolidate market depth Bid and Ask levels into a larger price increment. This increment is dynamically calculated on our server.

In this case what Sierra Chart will do, is it takes the market depth Bid or Ask price price and rounds it to the nearest increment being used. Every market depth Bid and Ask price that is rounded to the same price, has its quantity/size added to the quantity/size for that market depth price level.

When viewing market depth in the Trade DOM columns you may need to increase the Chart >> Chart Settings >> Tick Size to a larger increment. For example, change it from .01 to 1.

Also refer to Customizing Trade DOM and Chart DOM Columns to add the Bid Size and Ask Size columns to view the market depth quantities/sizes on the Trade DOM or Chart DOM.

Important: Volume at Price Studies with Cryptocurrency Symbols

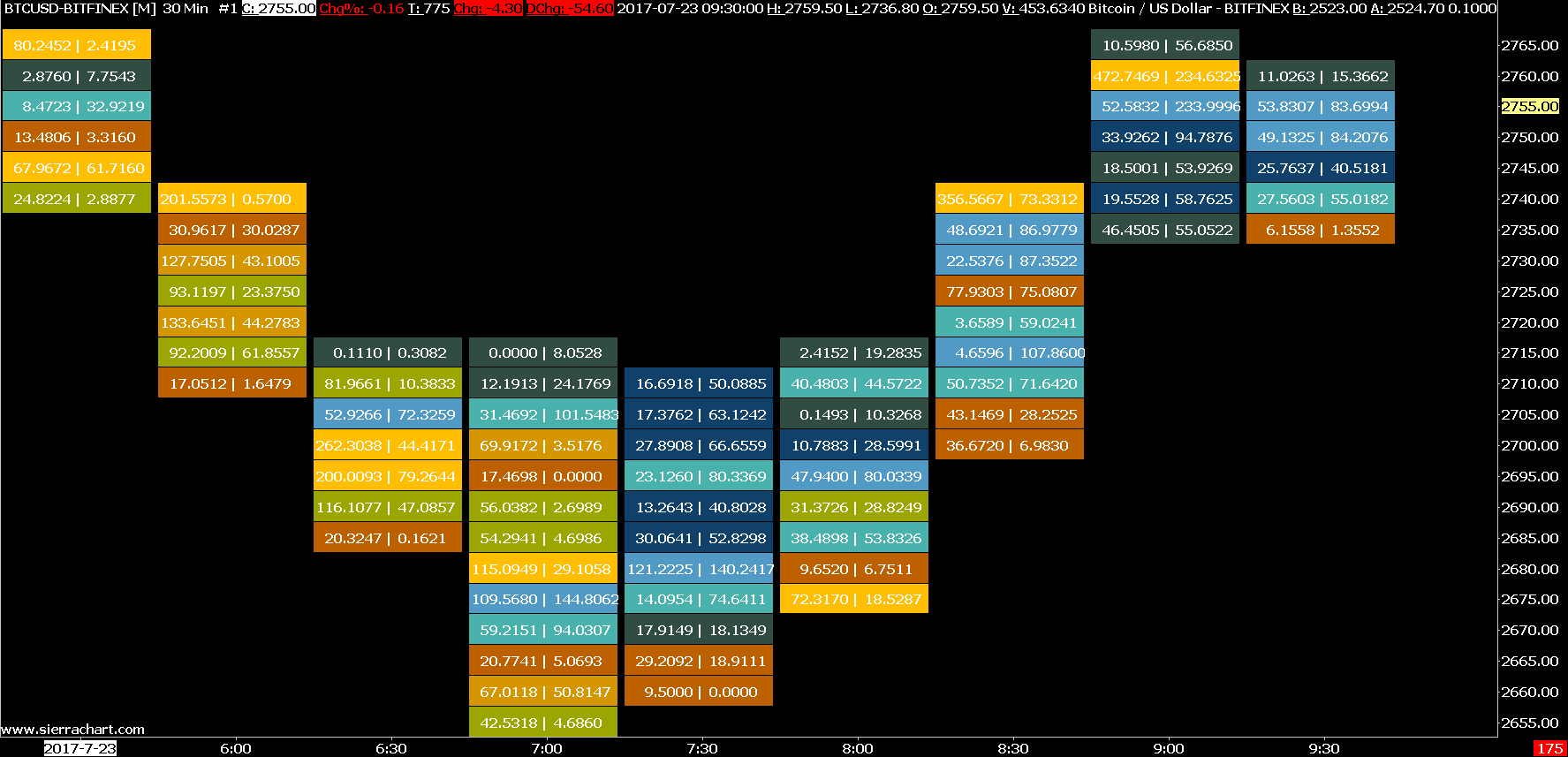

The Numbers Bars, Volume by Price, and TPO Profile Chart studies can be used with any of the Cryptocurrency symbols provided by Sierra Chart. These studies use volume at price data.

Due to the wider range of prices and higher prices with crypto currency symbols, it will often be necessary to adjust the chart Tick Size to a larger increment in order to get a readable display and to improve performance.

Otherwise, there may be an enormous amount of processing involved to handle smaller tick sizes which would be very inefficient and cause Sierra Chart to freeze at times, sometimes for a long time, while Sierra Chart is doing the necessary volume at price processing.

With a very small Tick Size like .00000001, another problem that can occur is that there is an integer overflow causing inaccuracy with the Volume at Price data.

Follow the instructions below to make the necessary adjustments to efficiently use the volume at price related studies with these symbols.

- First make sure there is no Study Collection automatically applied to a new chart when opened to avoid any problem caused by studies that use volume at price data.

- Open an Intraday chart for a Cryptocurrency symbol or go to an existing Intraday chart. To open a new chart, refer to Find Symbol.

- Select Chart >> Chart Settings >> Symbol.

- If the symbol has values of 100 or higher, it is recommended to set the Tick Size setting to 1. Increase this Tick Size as required based upon the pricing of the symbol. You may even need to make the Tick Size 100 or 1000 times higher.

Alternatively, you can increase the Volume at Price Multiplier setting. Increase the Volume at Price Multiplier to 100 or 1000. - Adjust the Price Display Format to correspond with the Tick Size setting.

- Set the Auto-Set From Data Feed option to No. This is absolutely critical!

- For some crypto currencies with very small values and that by default are using a small Tick Size like 0.00000001, it is also necessary to set the Real-time Price Multiplier and Historical Price Multiplier in the Chart Settings to 10000, along with changing the Tick Size to be four decimal places larger. For example, if the Tick Size is 0.00000001, then it would change to 0.0001.

- To avoid the Tick Size from being changed back to a smaller value when you change the symbol of the chart, or duplicate the chart, it is important to set to Yes the setting Symbol >> Do Not Change Symbol Settings for Chart on Symbol Change on the Chart Settings window.

- Press OK.

- It must be emphasized, that it is necessary to first make these changes before using the Numbers Bars, Volume at Price, or TPO Profile Chart studies on the chart to avoid Sierra Chart from freezing for an extended time due to excessive processing from a Tick Size which is too small.

- Add the Numbers Bars, Volume at Price, or TPO Profile Chart study to the chart. In the case of the Numbers Bar study, refer to the Numbers Bars Step by Step Instructions.

- You will notice with these studies that the price levels displayed are according to the Tick Size you have set. Although in the case of the Volume by Price study, this is also dependent on the Ticks Per Volume Bar Input setting.

- If there are too few price levels, you can decrease the Tick Size to a smaller value. If there are too many levels, you will need to increase the Tick Size setting to a larger value.

Daily Open, High, Low, Previous Close Values

The Daily Open, High, Low, and Previous Close for the current day as displayed in the Window >> Current Quote Window , and for prior days displayed in Historical Charts are calculated by Sierra Chart. These calculations are based upon Intraday trades from 0:00:00 UTC to 23:59:59.999999 UTC.

These values do not come from the various crypto currency exchanges. So they will not necessarily match the exchange values.

Keywords: Crypto Currency

*Last modified Thursday, 01st February, 2024.